Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

The cryptocurrency industry has come a long way and today there are around 22,932 cryptocurrencies available.

Considering the relative volatility of the cryptocurrency market today, it’s essential for investors to understand trading dynamics, investment expectations, and their strategies.

Volatility – the rate at which the price of an asset moves for a set of returns – is a crucial factor to consider when investing. Although higher volatility is generally linked to the potential for higher returns, it is also associated with a higher risk, underscoring the need to understand the asset you’re investing in and the strategy you’re using.

What are the main trends shaping the cryptocurrency world in 2023?

Increased investment by financial institutions

The May 2023 report from KPMG indicates a confident step toward cryptocurrencies by large financial institutions. For example, renowned banks and investment firms, including Goldman Sachs, are launching their own crypto asset products and services.

Growth of Decentralised Finance (DeFi)

DeFi represents a new generation of financial services accessible via blockchain technology. Unlike traditional financial services that rely on intermediaries, DeFi services facilitate transactions directly between parties, thereby democratising access to personal finance.

Expansion of Non-Fungible Tokens (NFTs)

NFTs are unique digital assets on the blockchain. While currencies like bitcoin are “fungible”, meaning each unit is interchangeable with another equal one, NFTs are “non-fungible”, making each unit unique and irreplaceable.

NFTs can represent anything from artwork to music. A popular example is CryptoPunks, unique pixel-art characters on the Ethereum blockchain, some of which have sold for millions of dollars. NFTs are gaining popularity as a means to buy and sell digital art, with sales reaching €24.7 billion in 2022.

Increased regulation

To further protect consumers and investors, regulatory bodies and government institutions are notably stepping up the level of action across the cryptocurrency industry.

The need for clear rules and regulations is evident, especially if the cryptocurrency industry is to continue growing on a global scale. In the EU, we have seen the adoption of the Markets in Crypto Assets (MiCA) framework, which aims to offer clarity and consistency across all EU markets when it comes to cryptocurrency regulations.

Increased adoption of cryptocurrencies

The increase in the adoption of digital assets is expected to be accelerated by merchants, social media companies, and telecommunications companies, marking a crucial shift in the cryptocurrency landscape. As these businesses explore opportunities to reduce transaction costs, foster engagement, and secure their roles in the digital economy, they’re opening up more practical use cases for cryptocurrencies.

From social media platforms transforming into cryptocurrency payment processors to telecommunications companies launching blockchain wallets, this expanded integration across different sectors is not only driving recovery in the cryptocurrency market but also fuelling an increase in the widespread adoption of cryptocurrencies.

As cryptocurrencies are characterised by volatility and unpredictability, it’s essential to note that the above trends can change rapidly.

Cryptocurrency market capitalisation

Market capitalisation, often shortened to market cap, is the total market value of all circulating supply of a specific cryptocurrency. It’s calculated by multiplying the total number of coins or tokens in circulation by the current market price of a unit. This indicator helps provide a size and relative value comparison among different cryptocurrencies.

As of July 2023, the top five cryptocurrencies by market capitalisation, representing 70% of the total market cap, were as follows:

- Bitcoin (BTC): With a market cap of approximately €595.5 billion, bitcoin is the pioneering and most recognised cryptocurrency in circulation.

- Ethereum (ETH): With a market cap of about €239.3 billion, ethereum today supports a blockchain-based platform that implements smart contracts and is seen as a potential game-changer in transaction processing.

- Tether (USDT): This is a prominent example of a stablecoin (a type of cryptocurrency whose value is pegged to an external asset, such as USD), boasting a market cap of about €83.5 billion.

- Binance Coin (BNB): With a market cap of around €38.69 billion, it is the native token of the Binance platform, one of the largest cryptocurrency exchanges globally.

- USD Coin (USDC):This is another example of a stablecoin, with a market cap of around €27.6 billion.

Due to the highly volatile nature of cryptocurrencies, the above information can change rapidly. Therefore, always make sure to check prices, trading volumes, and market caps from reliable sources like Skrill.

Market expectations for 2023

Events from last year, such as the LUNA crash, the FTX collapse, and the Celsius bankruptcy, considerably impacted the cryptocurrency market, resulting in a 62% drop in market cap overall to about €835 billion.

Institutional adoption of crypto remains robust, and that’s good news. A survey from Fidelity Digital Assets reveals that about 58% of institutional investors have already invested in digital assets.

Looking ahead, we foresee increasing demand for regulatory clarity and improved governance in the cryptocurrency industry. With the growing interest from institutional investors, regulations will play a critical role in stimulating broader acceptance of cryptocurrencies.

The ripple effect of this acceptance could lead to less volatility in the market, strengthening the confidence of both institutional and private investors. This regulatory progress will likely heighten the prominence of decentralised finance (DeFi), NFTs, and stablecoins within the crypto ecosystem, furthering the continued growth of crypto adoption.

However, the evolution of the regulatory landscape also introduces a new layer of complexity and uncertainty.

It’s crucial to be mindful of the associated risks too, including the rise in fraudulent activity within the cryptocurrency space. With a 28% increase in reported fraud cases in 2022, it’s clear that the growth of the crypto market also attracts malicious actors. Therefore, you need to carefully examine all crypto-related investment opportunities to ensure they are legitimate.

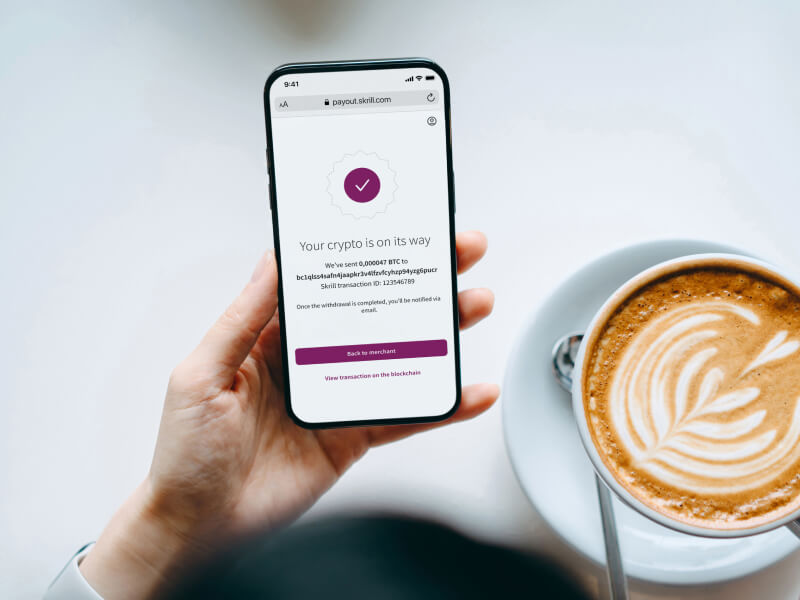

In this context, platforms like Skrill with its secure systems and user-friendly interface, play a crucial role in helping users start investing in today’s ever-changing landscape of cryptocurrencies.

In conclusion, while the sector is filled with volatility and uncertainty, it’s also packed with innovation and potential for significant changes in how financial transactions are conducted. With the growing interest from institutions, technological advancements like DeFi and NFTs, and increased regulation, the cryptocurrency landscape will continue to change rapidly.

Therefore, it’s essential to stay up to date with the latest trends and developments. Remember, investing in cryptocurrencies carries risk, so you should always do thorough research and, when necessary, seek professional advice before making any investment decision.

With a Skrill account, you can buy and sell cryptocurrencies, as well as learn about crypto in our academy.

Open a Skrill account Learn more about cryptocurrency