Virtual wallets have become hugely popular in the past few years; a trend that’s set to continue. In fact, according to a study by Juniper Research, the total number of people using digital wallets will exceed 5.2 billion globally by 2026, meaning that more than 60% of the world’s population will have a virtual wallet.

But what’s fuelling the growth of digital wallets? Are they just another means of payment, or something more?

Interestingly, some like Skrill facilitate other types of transactions beyond paying for purchases.

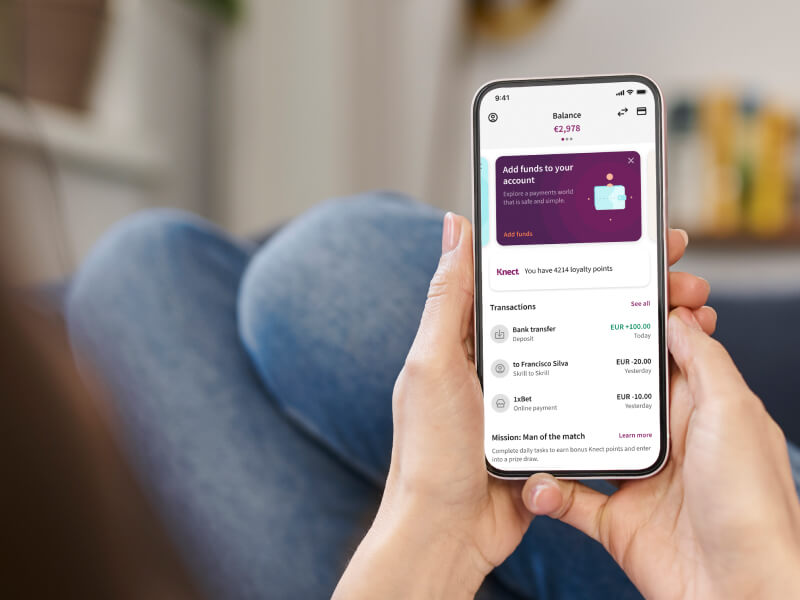

Skrill, for example, allows you to use the funds in your account to buy and sell cryptocurrencies or send money abroad. With the Skrill app, you can even hold balances in different currencies and easily exchange one currency into another while checking the conversion value.

Most virtual wallets can be downloaded directly to your smartphone by installing the corresponding app. With the app, you can make transactions anytime, anywhere.

The world of digital wallets like Skrill is expanding because it offers practical, cheap and convenient solutions, unlike some traditional payment methods.

What are the main features of the Skrill app?

1. Online payments: Enjoy speed and ease when paying online, shopping with Skrill or withdrawing money from merchants. Various websites offer Skrill as a payment method, whether you’re betting, trading or gaming.

2. Transfer money: Send money instantly in more than 40 currencies. All you need is your recipient’s email address or phone number.

3. Currency exchange: Hold a balance in multiple currencies and instantly exchange from one to another.

4. Cryptocurrency: Buy and sell over 40 different cryptocurrencies, including Bitcoin, Ethereum, and more.

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.

5. Loyalty rewards: Earn points with Knect, Skrill’s loyalty program, and exchange them for credit in your account.

Why should I download the Skrill virtual wallet app?

1. Pay on the go: The Skrill app puts payments at your fingertips, wherever you are.

2. Convenient: You can use multiple devices with your Skrill account. Add up to five trusted devices with no additional authentication.

3. Helps you keep track of your expenses: The Skrill app makes it easy to manage finances and track your expenses easily.

Is the Skrill virtual wallet safe?

Skrill’s security protocols have been developed to deter cyber-attacks. Here are some of the reasons why the Skrill app is safe for your financial transactions:

- When you pay, all your sensitive financial details are hidden from the recipient.

- Skrill uses the latest fraud prevention technologies, with transactions protected using Secure Socket Layer (SSL) technology with high-security encryption.

- With the app, you can enable your fingerprint or facial biometrics as the login method, so only you can access it. You will also be asked to create a PIN to enter when opening the app from a new device.

How do I get the Skrill virtual wallet app?

To download Skrill, go to the Apple App Store or Google Play Store. Or simply tap the buttons below.

Get it on Google PlayDownload on the App Store

Once you’ve downloaded the app, you can log in (or register if you don’t have an account yet) to start sending and spending on the go.