Payment processing is a central element of the puzzle when setting up your eCommerce website. It refers to the way in which online payments from customers are processed in order to finally arrive in your merchant bank account.

The payment processing chain offers merchants a convenient and quick solution to accept payments via their eCommerce stores. Read on for a full explanation of the parties involved, and how online payment processing works.

What Is Payment Processing?

Payment processing is the way in which a payment made by a customer on your eCommerce website makes its way to your account.

This process requires several parties working together to ensure that the customer has the necessary funds to pay for the product or service they want and to then transfer the funds to the merchant’s account.

Which Parties Are Involved in Processing a Payment?

The parties involved in the payment processing chain are as follows:

- Customer - the person who makes an order on your website and proceeds to pay with a debit or credit card.

- Merchant - the business (you) that provides the product or service and wants to accept the debit or credit card payment by the customer.

- Payment gateway - the payment gateway is the secured connection between your website’s shopping cart and the payment processor.

- Payment processor - also known as the payment service provider (PSP), the processor authenticates the transaction with the issuing bank regarding the availability of funds in the customer's account and then confirms or rejects the transaction. Often, but not always, your bank may serve as your payment processor.

- Issuing (customer) bank - the bank from which the customer's funds will be transferred.

- Acquiring (merchant) bank - the bank at which you, as a merchant, will receive funds in exchange for selling your products or services.

How Does Payment Processing Work?

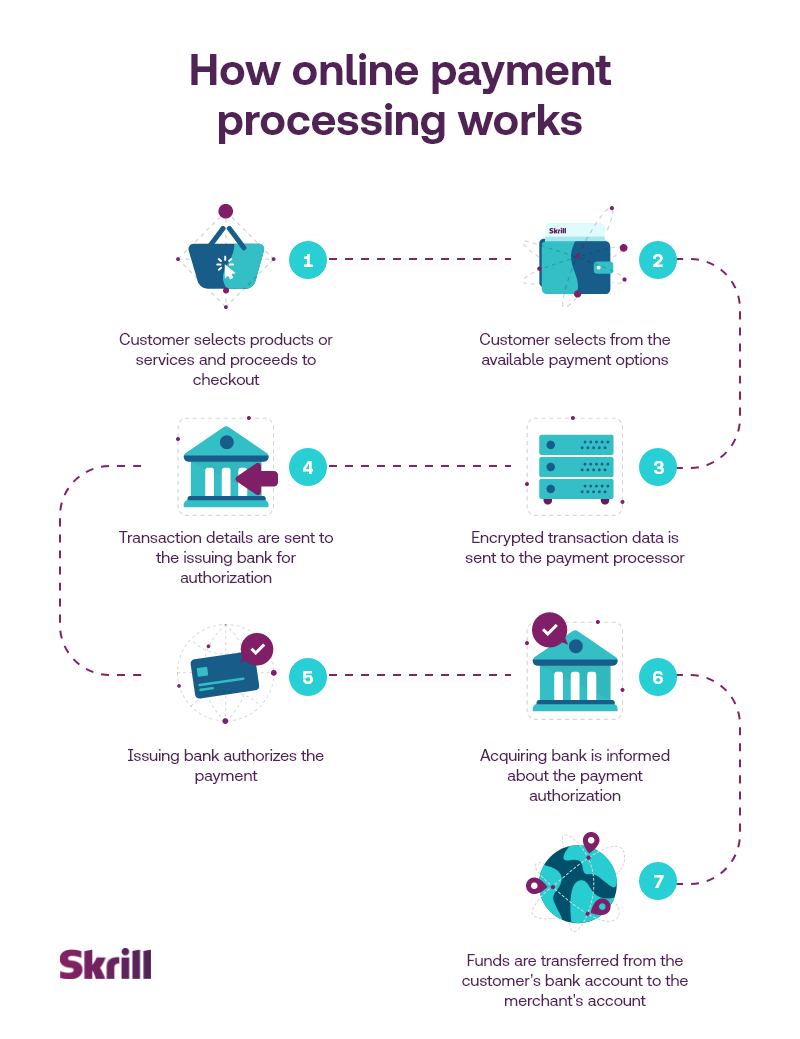

There are several steps involved when processing a payment from the customer bank account to the merchant account. The whole process takes no more than a couple of seconds.

Here is how online payment processing works:

- A customer selects products or services from your website and proceeds to checkout.

- During the checkout stage, they complete their payment details and select their preferred method of payment - a credit or debit card, a bank transfer, or some other form of payment, depending on what your payment gateway allows.

- Upon the customer submitting their order, the payment information is encrypted by the payment gateway, so as to protect the customer's data and details, and is forwarded to the payment processor.

- The payment processing service then relays that information to the customer's card issuer (i.e. issuing bank). This is done in order to check the veracity of the payment details and to determine if the customer has the means to make that payment.

- The bank then responds to the payment processor, confirming that the payment can be made or rejecting it.

- If the payment is confirmed, this information is sent back to your merchant account via the payment processor.

- The issuing bank transfers the funds to the acquiring bank, and into your merchant account.

Check out the infographic below for a visualization of the above steps.

What Is The Difference Between a Payment Gateway and a Payment Processor?

The payment gateway is the software that encrypts the customer’s transaction data and sends it to the payment processor. It enables you, the merchant, to provide your customers with various payment options, such as credit and debit card payments, bank transfers, eWallets, and other alternative payment methods.

The payment processor, on the other hand, receives the encrypted transaction information from the payment gateway and then sends it to the credit card network and the issuing bank for authorization. It provides the exchange of information between the acquiring bank, the issuing bank, and you, the merchant.

The online payment gateway and payment processing can sometimes be provided by the same company. Often, your bank will serve as your payment processor. At other times, the payment processor may be supported by the eCommerce platform that you use for your website, such as Magento, Shopify, etc.

How to Open a Merchant Account and Start Accepting Payments?

With Skrill, you can open a merchant account and install our payment gateway in a few easy steps. Check out our step-by-step guide on how you can open a business account with Skrill.

By adopting Skrill as a payment gateway on your website, you will enable your customers to:

- Pay in a variety of ways that include credit and debit cards, digital wallets, instant bank transfers, and various other alternative payment methods

- Pay in one of over 40 supported currencies

- Check out quickly and seamlessly across all devices

- Have their data protected

For you, as a merchant, the benefits of a good payment gateway include:

- Having one account in which you will manage your funds

- Being protected against fraud

- Receiving multi-lingual support

- Outstanding user experience resulting in a higher conversion rate

- Having access to millions of Skrill Wallet holders from all over the world

Do you want to try Skrill as your payment gateway?

Sign up now to get a business account!