Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Starting your cryptocurrency journey involves more than just buying and selling digital coins. It requires a strategic approach that’s no different from traditional investment planning - the creation and management of a diversified crypto portfolio. This crypto portfolio, a varied collection of cryptocurrencies you own, helps spread risk while potentially improving returns over time.

How do you achieve a well-balanced crypto portfolio? Diversification is key. Diversification involves spreading your investments across multiple cryptocurrencies, reducing the potential damage if one asset does not perform well.

Much like a traditional investment portfolio, it requires regular check-ups and rebalancing. To help with this, platforms such as Skrill provide an easy-to-use interface where you can keep track of your crypto investments in real-time. It should be noted that crypto is a risky investment, and you should only invest what you are prepared to lose.

Advantages and disadvantages of portfolio diversification

Before you dive into the process of creating a diversified crypto portfolio, it’s important to understand the potential advantages and drawbacks. As experts like the Nobel Prize winner Harry Markowitz have pointed out, diversification can be a way to manage risk and potentially enhance returns.

Advantages

By spreading your investment across multiple assets, you enhance the likelihood of cushioning your portfolio against significant losses. This is because if one asset underperforms or loses value, the gains or stable performance of another asset can counterbalance the impact.

Think of it like a seesaw; when one side goes down, the other might rise, ensuring the structure remains steady.

Disadvantages

On the other hand, diversification may limit your potential gains. If a significant portion of your crypto portfolio is invested in assets offering lower returns, you might miss out on higher market gains from other assets.

Additionally, maintaining a diversified portfolio involves constant monitoring and rebalancing, which may incur trading fees and time commitment.

Remember, there is always a trade-off between risk and return, and your degree of diversification is a personal decision based on your risk tolerance, financial goals, and investment timeline.

Fortunately, with a Skrill account you have access to over 40 cryptocurrencies. This gives you plenty of options for your crypto asset portfolio.

Diversifying your crypto portfolio

The leading players like Bitcoin and Ethereum are well-known, but a multitude of other cryptocurrencies exist. Consider including the following crypto assets in your diversified portfolio:

Crypto ETFs: A cryptocurrency Exchange-Traded Fund (ETF) is an investment vehicle that tracks the performance of a selection of cryptocurrencies. For novice investors looking to invest in cryptocurrencies without the complexities of buying and managing individual coins, a crypto ETF may be the best fit. It offers instant diversification as it bundles different crypto assets in one place.

Stablecoins: As their name suggests, these are designed to provide stability in the volatile crypto market.

They are usually pegged to a reserve of assets such as fiat currencies, other cryptocurrencies, or commodities, helping to maintain a consistent value.

Examples of stablecoins include Tether (USDT), USD Coin (USDC) and DAI.

NFTs: Non-fungible tokens, or NFTs, represent ownership over unique digital items such as artwork, music, and virtual real estate. While they are not cryptocurrencies themselves, they exist within the crypto ecosystem and carry their own value, which can be leveraged for portfolio diversification. However, NFTs carry significant risk because they are relatively new and experience extreme price volatility.

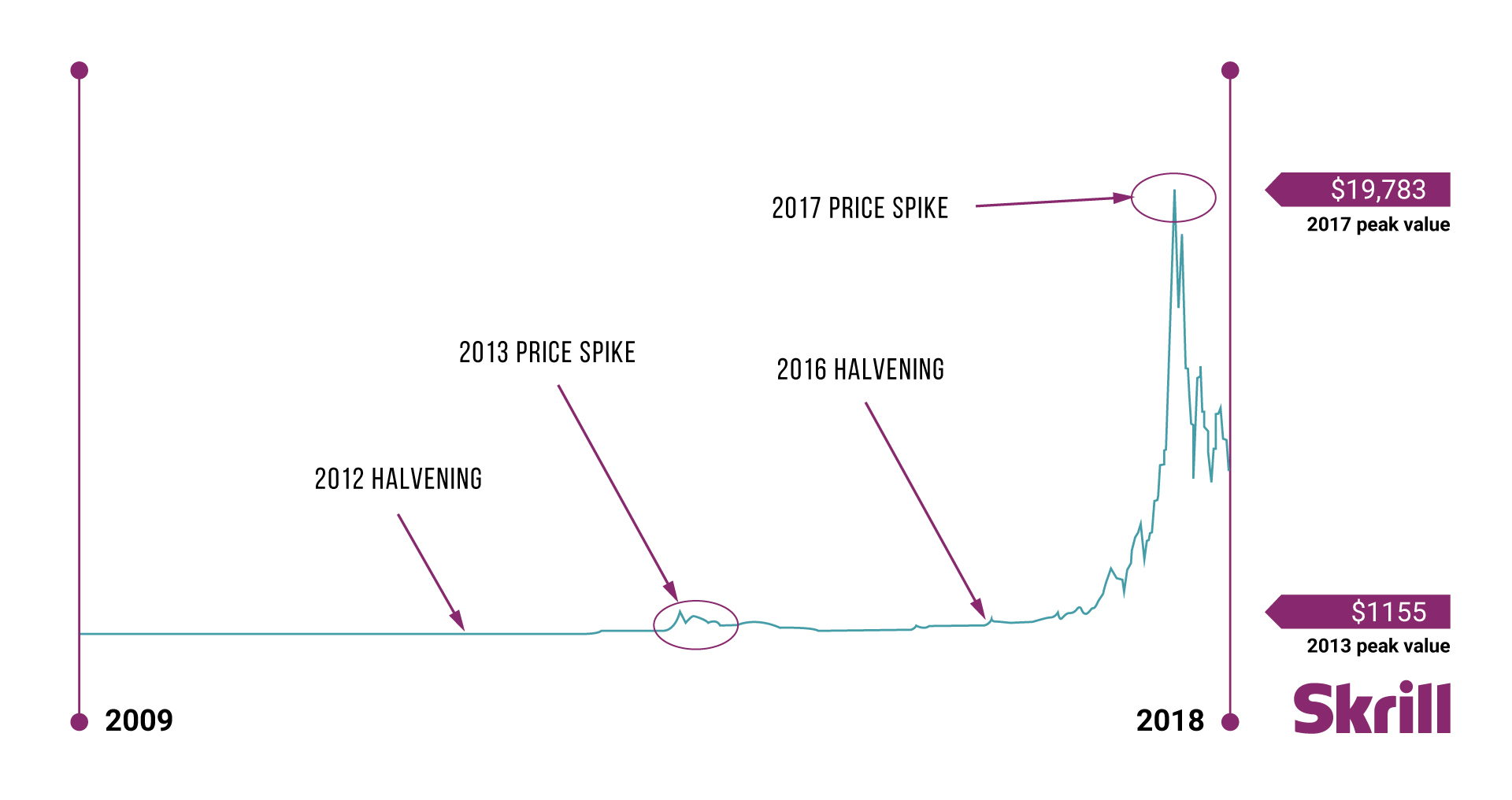

Bitcoin and Ethereum: Bitcoin, often referred to as “digital gold”, revolutionised the financial world in 2009. Establishing the use of blockchain technology, a decentralised public ledger, Bitcoin has been a yardstick for other cryptos. Ethereum, on the other hand, enhanced the idea of blockchains. Known as a programmable blockchain, Ethereum allows the creation of decentralised applications and smart contracts. Today, both are the leaders in market capitalisation at USD 571 billion and USD 221 billion respectively.

Altcoins: Altcoins, short for “alternative coins”, represent cryptocurrencies other than Bitcoin. They’ve gained traction and offer potential for investors keen on diversifying their portfolios. Some noteworthy altcoins include: Ripple (XRP), Binance Coin (BNB), Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Tron (TRX) and Polygon (MATIC).

Crypto investment strategies

When you set out to invest in cryptocurrencies, it’s crucial to have a strategy. Here are some commonly used approaches in the crypto space:

- Holding: This involves buying and holding onto cryptocurrencies with the expectation that their value will increase over time. It’s a passive, long-term strategy suitable for those who can tolerate market volatility.

- Yield farming: This is a more advanced strategy where investors lend their cryptocurrencies on decentralised finance (DeFi) platforms in return for interest. It’s akin to earning interest in a traditional bank account, but generally offers higher potential returns with added risk.

- Staking: This is the process of actively participating in transaction validation (similar to mining) on a proof-of-stake (PoS) blockchain. In staking, you can earn rewards for holding and contributing to the upkeep of a particular cryptocurrency.

- Trading: This strategy involves frequently buying and selling cryptocurrencies to exploit market price movements. However, it’s riskier for beginners due to the highly volatile nature of the crypto market.

Crafting a well-balanced crypto portfolio demands meticulous planning, diversification, and the right toolkit for investment management. With a Skrill account, you can buy, hold, and track over 40 different cryptocurrencies in a secure digital environment.