Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

Skrill's cryptocurrency service isn't available where you are. Click here to visit our US website.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Disclaimer: This guide is intended to help Skrill customers navigate new technology in a straightforward way. It is not intended to be financial, investment or trading advice. This guide is for information and solely for educational purposes. It does not protect you from financial loss, risk or fraud.

What is cryptocurrency?

Cryptocurrencies are digital currencies secured by cryptography. It can act as a medium of exchange for the sale, purchase or trade of goods and services without the need for an intermediary, like a bank.

As cryptocurrencies are digital assets, they can’t be held physically – they only exist online.

While some cryptocurrencies are fully decentralised – meaning no central entity controls them – others are issued by companies and/or managed by a group of people with a majority control.

Cryptocurrencies are protected using cryptography; a method of keeping information secure using codes.

How is cryptocurrency created?

Cryptocurrency is created by mining.

What’s mining? Mining is the process by which new coins enter circulation. It is performed using computers to solve computational maths problems and is carried out to secure the network.

Mining relies on distributed ledger technology (often referred to as ‘blockchain’). Blockchain is an independent public peer-to-peer network that’s currently not subject to regulation. The blockchain securely stores a series of timestamped records (cryptocurrency transactions) within a decentralised network.

What features do most cryptocurrencies have?

Irreversible – it’s very hard for anyone but the person who owns the cryptocurrency to move it. As the owner holds the private key, they have the unique code to access it. Transactions can’t be changed once they are recorded.

Limited supply – most cryptocurrencies have a limited and pre-determined supply.

How does cryptocurrency work?

Cryptocurrencies are designed to work in different ways.

Some cryptocurrencies are meant to behave like money; they act as a means of payment. Others have more in common with traditional investments, like shares, bonds, or funds.

Cryptocurrencies are largely unregulated, which means there can be a large degree of risk when investing in them.

Where and how do I store cryptocurrency?

A cryptocurrency wallet gives you access to cryptocurrencies and lets you to buy, store and hold them. Some wallets only support one type of coin, while others support multiple.

Each wallet has a private and a public key. You can think of a public key as your wallet address because like a bank account number, people use it to send cryptocurrency to your wallet. A private key works like a PIN or a password; you enter it to send and receive cryptocurrency.

Get an account today

- Pay quickly and easily without relying on your bank

- Send money instantly in over 40 different currencies

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Your wallet can be on an external device, software, a personal computer, a smartphone, or an online account associated with an exchange.

|

Type of wallet |

Location of key |

Where the software runs |

|

Web wallet – hosted |

Stored by a trusted third party |

On the server of third party |

|

Web wallet – non hosted |

Stored by user |

Browser |

|

Desktop/mobile wallet |

Stored on the device used for the wallet |

Separate program on device |

|

Paper wallet |

Printed on paper |

Used with all types mentioned above |

|

Hardware wallet |

Stored on specific device and never visible |

Interface runs in a browser or separate programme |

How do exchange wallets work?

Wallets stored on exchanges are called hosted web wallets, which means your keys are stored online by a trusted third party.

This gives you the option to recover your password if you forget it, but you don’t have ultimate control over your funds as they are stored by someone else (and therefore at risk of hacking).

Most exchanges let you to keep your cryptocurrency within your online account.

Are exchanges secure?

Cryptocurrency exchanges are entirely digital and, as with any virtual system, at risk from hackers, malware and operational glitches.

Even though exchanges take steps to preserve the security of their platforms, wallets provided by exchanges can be hacked. A serious hack could put a cryptocurrency exchange into insolvency.

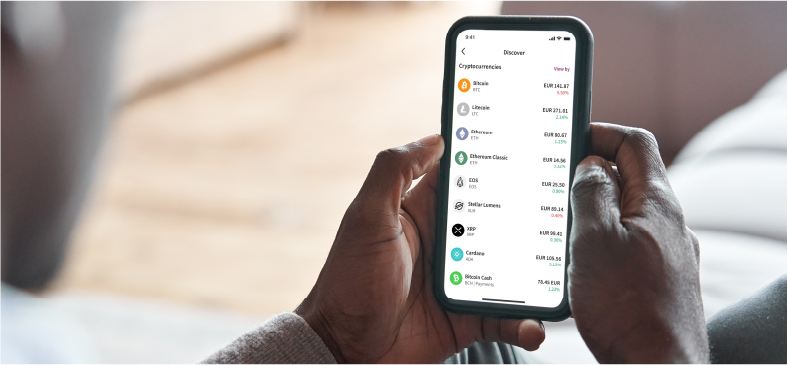

How can I use Skrill to buy and sell crypto?

Skrill partners with reputable exchanges to let you buy, sell and send interests in more than 40 cryptocurrencies. Each partner exchange must pass strict checks before we offer their services to you.

We’re not a cryptocurrency wallet and we’re not an exchange; we simply facilitate crypto transactions.

Why people use Skrill for crypto:

- Instant transactions to quickly take advantage of price movements

- Real-time price alerts keep you on top of changes in the market

- Conditional orders let you buy and sell without even logging in

- Recurring orders help you grow your portfolio with repeat purchases

To offer these services, we charge a fee. You can find more information about our fees in the Skrill Terms of Use.

What is the difference between cryptocurrency and fiat (government-backed currencies)?

|

Cryptocurrency |

Fiat |

|

|

*In case you’re interested, here a few different ways people can receive crypto:

Mining – utilising computers to solve complex mathematical problems.

Air drops – when the creator of a cryptocurrency sends coins to different wallets.

As interest (also known as yield farming) – when you lend your capital to someone in exchange for a return.

What are the differences between the cryptocurrencies?

Cryptocurrencies have unique characteristics and perform different tasks and functions. In the UK, they are classed in the following categories, most of which (save for CBDC’s) are available to buy on different exchanges...

|

Type of Token |

Description |

|

Exchange token |

Used as a means of payment or exchange |

|

Utility token |

Gives user rights or access to services or products |

|

Security token |

Similar to traditional investments e.g. shares |

|

E-money token |

Digital representations of a unit of fiat |

|

Stablecoin |

Cryptocurrency with a value linked to an underlying stable asset e.g. gold, USD |

|

Non-Fungible Tokens |

Digital representation of value for a unique digital asset |

|

Central Bank Digital Currency (CBDC) |

Digital forms of money representing a direct claim on a central bank |

What are the risks when buying cryptocurrencies?

In some jurisdictions, cryptocurrencies aren’t regulated beyond anti-money laundering requirements or at all. So, when you buy cryptocurrency, you don’t benefit from the same protections afforded to regulated payment services.

Trading in cryptocurrencies carries special risks not generally shared with official currencies, goods or commodities in a market.

For example, cryptocurrency isn’t backed by governments, other legal entities or commodities like gold. As a result, no central bank will take corrective measures to protect the value of cryptocurrency in a crisis.

The value of cryptocurrencies is volatile, and the market is new and uncertain. Prices can rapidly increase or decrease at any time and may even fall to zero, making it hard to value reliably.

The market is highly susceptible to manipulation. For instance, ‘pump and dump’ schemes – attempts to boost the prices through false, misleading or exaggerate statements – can push prices up.

Cryptocurrencies are complex products susceptible to sudden loss of confidence (irrational or otherwise), which collapse demand relative to supply. This means there is no guarantee that cryptocurrency can always be converted back to cash.

Given the various risks around cryptocurrency exchanges (including the uncertain legal environment) it’s possible for an exchange to collapse losing your money.

No centralized authority controls the technology that cryptocurrencies run on. Sudden changes in operating rules (‘forks’), can affect the value, function, and even the name of the cryptocurrency.

How do I avoid cryptocurrency scams?

Scams happen in the world of cryptocurrency. To avoid becoming a victim of a fraud, it’s good to be aware of the scams out there.

Fake apps or websites – imposter apps or websites exist that look very similar to well-known apps and websites. Always use a website with a small lock icon next to the site address and an https link. If you’re using an app, check that it’s verified.

Scamming emails – these might look like emails you’ve received from a legitimate business. Always check the address an email has come from to confirm it’s from the real company.

Unrealistic claims – some scammers guarantee you will make an unreasonable profit, free money or receive big pay-outs with guaranteed returns. The fraudsters can’t back up these claims with details or truthful explanations.