Once, all money was physical. Whether in the form of notes, coins or tokens, money was something you held in your hand. Today, physical money continues to exist, but much of what we think of as ‘money’ only exists digitally or electronically. And that’s not only true of cryptocurrency. In fact, much of the ‘regular’ money in the world today is purely electronic.

Some countries (like Sweden) take electronic money very seriously and are in fact moving towards becoming ‘cashless societies’ with all transactions being conducted electronically.

What is electronic money?

At a basic level, electronic money is simply money stored on some kind of computerised device. Examples of electronic money include cryptocurrencies, virtual currencies, central bank digital currencies and e-cash. It can be used to complete transactions, with or without bank accounts.

The fact that electronic money doesn’t have a physical form is what makes it so useful. Being digital allows for nearly instantaneous transactions anywhere in the world, including across borders.

Common examples of electronic money

Central bank digital currency

The most common example of electronic money is the electronic money issued by central banks, for example, when they increase the supply of money in the economy.

Through the financial system, this money makes its way to regular banks used by customers.

Because these banks have liquidity requirements, they need to have a certain amount of physical money on-site. However, there are no such requirements for digital money. In fact, many banks handle sums in the millions, but sometimes never see any physical cash at all, as all the money passes through them digitally.

Cryptocurrency

Another common example of digital money is cryptocurrency. Cryptocurrency is mined, traded, or bought, and kept in digital wallets.

Common examples include Bitcoin, Ethereum, Litecoin, and Ripple. Please read our Cryptocurrency Risk Statement if you are considering a trade.

Make your money move with Skrill

Need a quick and easy way to pay without relying on your bank?

With Skrill you can pay online and send money to friends without ever sharing your bank details.

Where can I use electronic money?

Every time you pay for something with a regular credit or debit card, or with a cryptocurrency like Bitcoin, you are using electronic money. In fact, an increasing number of new digital currencies (including the well-known cryptocurrencies) can be used to buy physical goods and services in the real world. Others, however, are restricted to certain communities such as inside an online game.

And remember, if you use your Skrill wallet to play games or pay for anything online, you’re also using electronic money.

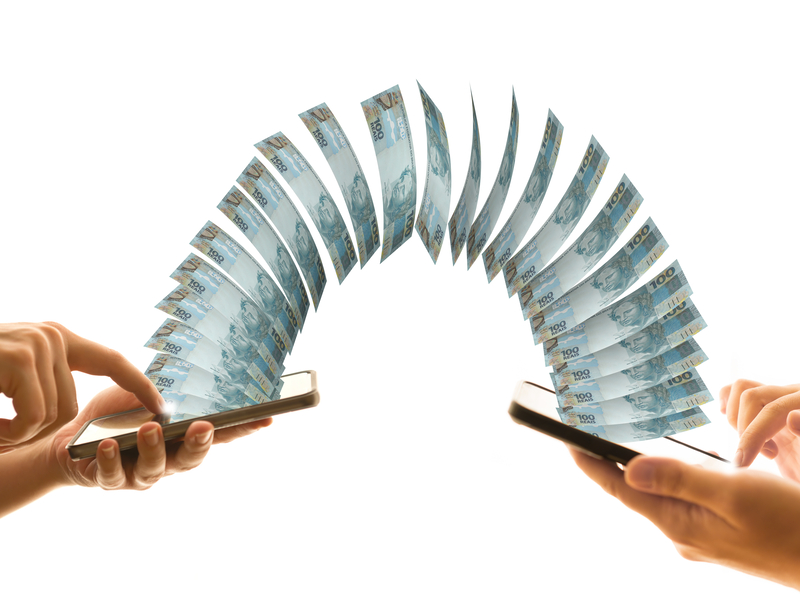

Transferring electronic money

Money movement is where electronic money really becomes useful. Physical stores of value are difficult and time-consuming to transport. But electronic money offers a completely different type of payment service, with the ability to move any amount easily, even across borders.

Payments using electronic money can be performed in a number of ways:

- Via debit cards, prepaid cards and credit cards

- With virtual platforms like Skrill

- Using mobile phones and personal computers – it’s now possible to send mobile payments to anyone with just an e-mail address or mobile phone number

The future of electronic money

Electronic money is remaking the ways we buy and sell. As more and more people move away from hard cash, and new electronic payment options such as Bitcoin become more widely used, electronic money is certainly here to stay, in all its different forms.

If you’re looking for an easy and stress-free way to use electronic money for online payments, gaming and more, check out what a Skrill wallet could do for you. We support a wide range of currencies, so you can transact in the way that’s right for you.