Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

The prospects of digital assets have caught the attention of investors around the globe. They now have a total market capitalisation of €1.2 trillion.

Yet entering the world of cryptocurrencies can be a challenging venture.

However, it’s crucial not to get lost in the hype when investing in cryptocurrencies. Educating yourself and doing your due diligence can help you navigate this ever-evolving space with more confidence.

Whether you’re aiming to invest in bitcoins for the first time or seeking to diversify with other promising assets, the crypto landscape offers many possibilities. By leveraging tools like Skrill, even beginners can enter this dynamic market, ensuring a smoother crypto journey.

Tips to navigate the crypto space

The world of cryptocurrencies is fast-paced and ever-changing. A strong foundation of knowledge can help you to make informed decisions. With that in mind, here’s our first tip.

Tip 1: Understand the buying and selling process before investing

If you have made up your mind to buy cryptocurrencies, first familiarise yourself with the process.

Finding a reliable platform that allows you to deposit and withdraw in your local (fiat) currency is critical because it facilitates an easier transition between your bank account and your crypto assets.

Platforms like Skrill make this transition seamless, allowing you to deposit money, invest in cryptocurrencies, and withdraw your profits back into your local currency.

The Skrill wallet is an essential tool that enables you to conduct transactions quickly, effectively and securely.

Tip 2: Diversify your portfolio

Financial experts often emphasise the importance of maintaining a diverse portfolio. This applies to crypto investments as well.

For instance, an investor may choose to distribute their capital among well-established cryptocurrencies and buy Bitcoin or Ethereum while also exploring areas such as DeFi (Decentralised Finance), NFTs (Non-Fungible Tokens), gaming, and layer-one protocols.

According to Investopedia, investing in a range of different crypto assets can help reduce risk and increase the potential for returns. In light of this, their top 10 altcoin recommendations are: Ethereum, Tether, XRP, Binance Coin, USD Coin, Cardano, Solana, Dogecoin, Tron and Polygon.

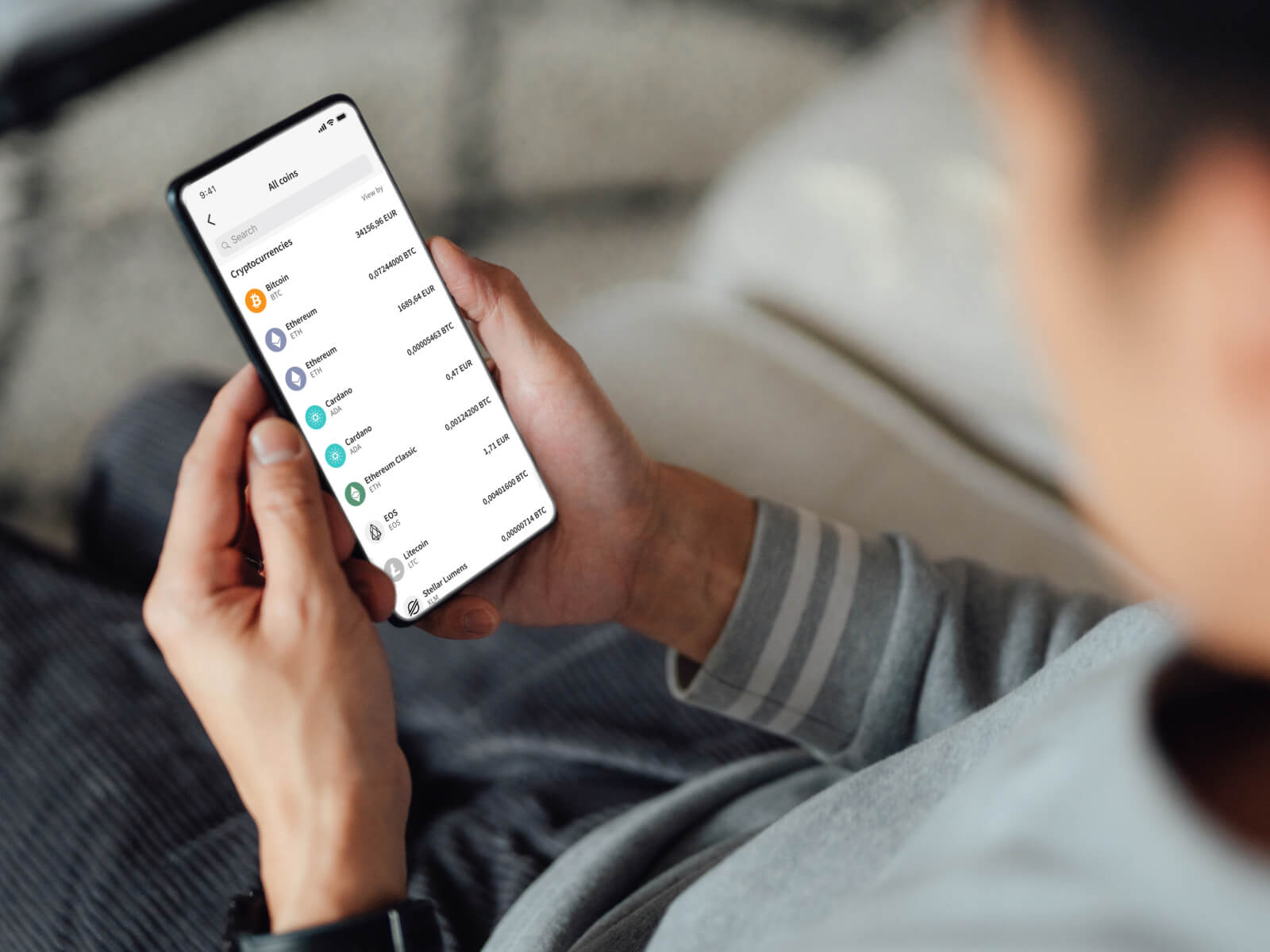

With Skrill, you can diversify your crypto investments. The platform allows you to buy interests in a range of cryptocurrencies and manage them in one place - your Skrill wallet.

Tip 3: Do your own research

Never make an investment in cryptocurrencies or any other asset simply because someone advised you to. It’s important to understand what you’re investing in.

Spend time researching the crypto project, its technology, its real-world use case, the team behind it, and its roadmap for the future. By conducting your own research, you’ll be better equipped to make informed decisions about why to invest in bitcoins or other cryptocurrencies.

Tip 4: Timing is crucial

Investment decisions should be based on rational analysis, not emotions. However, it’s not uncommon for investors to make impulse decisions driven by a Fear of Missing Out (FOMO).

This is especially true in the crypto market, where prices can skyrocket in a short time. If a token’s price starts to rise dramatically, it can attract a wave of investors looking to capitalise on the trend, often driving the price even higher.

However, if you invest at the height of this rally, you could end up buying at an inflated price, and potentially face losses if the price then drops. Therefore, it's essential to resist FOMO, be patient, and wait for the right opportunity.

Tip 5: Only invest what you can afford to lose

Investing in the crypto market can be risky. It’s important to remember that you should never invest more than you're willing to lose.

The funds you allocate to crypto investments should be separate from your essential living expenses and your emergency savings.

Skrill’s platform makes it easy to keep track of your crypto investments. With their intuitive interface, you can monitor the price of cryptocurrencies and make decisions based on real-time data.

Tip 6: Keep the long term in mind

The allure of quick profits can often distract investors from the bigger picture.

Cryptocurrencies aren’t a get-rich-quick scheme; they are digital assets that can hold significant long-term value. Investing in crypto is not a sprint, but a marathon.

Many people overlook the fact that Bitcoin, the first and most famous cryptocurrency, took over a decade to reach its current status. This long-term growth trajectory is not unique to Bitcoin and can be seen in several other cryptocurrencies as well.

With the Skrill app, you can make long-term investments with confidence.

Investing in the crypto market requires preparation, understanding, and a well-thought-out strategy. Educating yourself and doing your research are crucial steps to becoming a savvy crypto investor.

Remember, while the crypto market can offer substantial opportunities, it also carries potential risks. Therefore, always be mindful of your investment decisions, diversify your portfolio, invest only what you can afford to lose, and keep your long-term goals in sight.

If you’re ready to start your crypto investment journey, Skrill offers a user-friendly platform to buy, sell, and manage a wide range of cryptocurrencies. Click here to learn more about investing in cryptocurrencies with Skrill.