Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

What is blockchain technology?

Blockchain technology was first outlined in 1991 by two American mathematicians and researchers. The pair wanted to create a system where a document’s timestamps (the digital record of how it’s changed over time) could not be tampered with.

When Bitcoin was created in 2009, blockchains received their first real-life use case for the technology.

Currently, the most common use case for blockchain is the underlying technology that cryptocurrency is built on.

A blockchain is a distributed ledger, often referred to as ‘Distributed Ledger Technology’ (DLT). A blockchain allows transactions to be facilitated and recorded among a network of computers, called nodes. Essentially, a blockchain is a database for any piece of information.

The technology works by collecting pieces of information in groups known as blocks. As new data is added to the network, new blocks are created and added to the chain. Each block has a certain amount of storage space.

Once the storage is full, the block is closed and cannot be changed anymore. This creates a transparent and immutable record of transactions in the blockchain.

The primary concept behind blockchain technology is having a large peer-to-peer network of multiple users or computers (the nodes) which can make secure and legitimate transactions without a third-party mediator. Any authorized node that is a part of the network can access the set of records as a block in the blockchain.

As a result, blockchains are nearly impossible to tamper with. However, hacks can happen.

Can blockchains be hacked?

Attacks on blockchains are called 51% attacks. These can only happen when a malicious actor owns more than 51% of a cryptocurrency’s total hashing or validating power.

The aim of a 51% attack is often to reverse a transaction to spend it again, this is called ‘double-spending’. The attack may also try to block other transactions. The likelihood of an attack happening is low due to the extremely high capital requirements for the attackers to gain control.

Key features of a blockchain

-

Programmable – A blockchain is programmable. This means that blockchains can follow certain rules and run automatically. A good example of this is smart contracts.

-

Validity – Due to every node having a digital copy of the ledger, when a transaction is added each node needs to first check and agree on the validity of the transaction. If the transaction is deemed valid, it is added to the ledger.

-

Secure – All records are individually encrypted. The encryption is done using cryptographic techniques that ensure the security of the data within the blockchain.

-

Anonymous – Participants don’t reveal their identities.

-

Immutable – Any validated records are irreversible and cannot be changed. The records are public and transparent.

-

Consensus – Consensus mechanisms are used to verify transactions and maintain the security of a blockchain by not allowing any unauthorised participants from validating bad transactions. There are many different types of consensus mechanisms with the most popular being Proof of Work (PoW) and Proof of Stake (PoS).

-

Distributed – All network participants have a copy of the ledger for complete transparency. This ensures a better outcome as the computational power is distributed across the whole network.

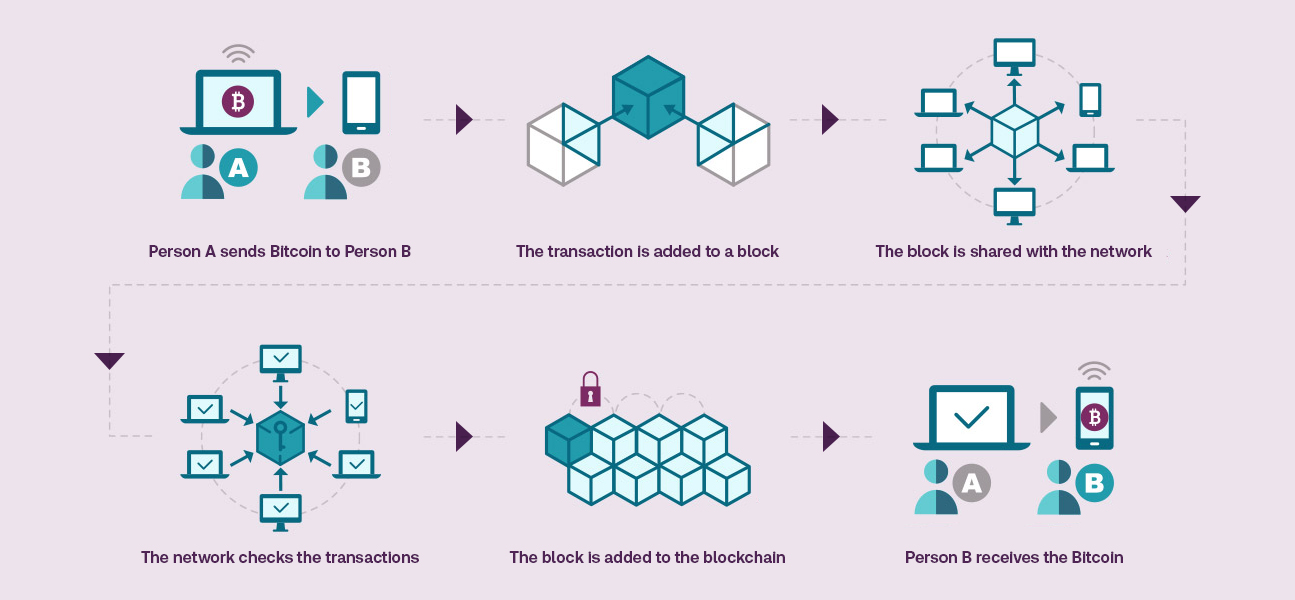

How do blockchains work?

Let’s use a cryptocurrency transaction as an example for how blockchain can work.

- “Person A” wants to send Bitcoin to “Person B”.

- The transaction, together with hundreds of similar transactions, is organised into a “block”.

- The block is shared to every party in the network.

- The network simultaneously validates the block of transactions – consensus is achieved only if all rules are followed.

- The verified block is then added to the unified blockchain, where transactions are immutable and transparent.

- “Person B” receives the Bitcoin.

Types of blockchains

There are a few different types of blockchains, with most differences based on whether the blockchain is public or private. The different features will be explored in detail later in the article, but the main difference is that the composition of public blockchains is decentralized, meaning no single person, entity or group has control over it. Private blockchains are generally controlled by a single entity.

Public blockchains

The most common example of public blockchains is cryptocurrencies. Public blockchains do not have any restrictions, meaning anyone can participate in the consensus and validation of the data.

There are no administrators who ‘allow’ users to participate in making changes to the blockchain. This is known as a permissionless distributed ledger system.

Anyone can become a validator and support the blockchain, the only requirement is to have access to the internet. The main difference to a private blockchain is that there is no single entity or organisation that fully controls the blockchain.

Private blockchains

With private blockchains, a single authority or organisation has control of the network. Participants in the blockchain (nodes) can only join via an invitation, where their identity is usually verified by the controlling authority.

The level of security, authorisations, permissions, accessibility is in the hands of the organisation. A reason for the controlling entity to limit the participants in the blockchain is to ensure that the data made available remains private.

Often private blockchains are used in specific industries such as healthcare, where the records should not be made publicly available.

Consensus mechanisms

Every blockchain has a cleverly designed architecture. The core part of this architecture is called consensus mechanisms, which is what enables the network to make decisions. There are many different types of consensus mechanism, with the two most popular used in blockchains being Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work (PoW)

In Proof of Work, each block of transactions has a specific hash – a long string of numbers. To confirm a block, a mathematical puzzle must be solved to generate a target hash that must be equal or less than the hash of the block. This process is called ‘mining’.

Miners compete with other miners to solve the puzzle the quickest. The miner that solves a block is allowed to include a transaction in his block and receives a block reward for doing so, most commonly in the respective cryptocurrency they are validating the transactions of. Bitcoin is an example of a PoW blockchain.

Proof of Stake (PoS)

The Proof of Stake mechanism was created as an alternative to the original PoW mechanism. There are key differences between the two mechanisms. In PoS, validators must hold and stake tokens to participate in the blockchain. The validators are selected by the blockchain to validate transactions and create new blocks.

The selection of validators is usually based on how much of the coin a participant holds but can also be random. For participating, the validators then receive a transaction fee. Staking is where owners of the respective coins allocate their coins to a validator to increase their chances of being selected to process the transactions.

Validators normally offer rewards to those who ‘stake’ their coins with them. These rewards are usually offered as a percentage of their allocated coins and in the form of the respective coin.

PoS uses far less computational power and is therefore seen as a more sustainable option when compared to PoW. Ethereum is an example of a PoS blockchain, having recently undergone the merge from PoW to PoS.

Real-world uses for blockchain

Since Bitcoin became the first real-world use case for blockchain technology in 2009, there has been a growing number of industries that have found applications for blockchain technology.

Below are just a few examples of industries that can apply and benefit from blockchain technology.

Cryptocurrency – Cryptocurrency protocols are built upon blockchain technology to enable a transparent record of ledger payments.

The most successful and popular cryptocurrency is Bitcoin. However, there are currently over 10,000 cryptocurrencies.

Politics and voting – Political elections are often scrutinized for the validity and authenticity of the votes received. Blockchain technology would ensure the transparency and authenticity of each vote cast.

Digital identity – As blockchains are almost totally tamper proof and secure, digital identities stored on a blockchain can protect individuals against any form of identity theft, granting them greater control over their identity.

Healthcare – Medical data can be stored on a blockchain to increase the security and validity of the records. The same can be applied to medical supply and the authenticity of medical drugs that are currently available in the global market.

This would lead to an improvement of care offered to patients.

Real Estate – Blockchain technology can help the real estate sector with two things: tokenizing and fractionalizing.

Tokenizing is the process of converting something of value into a digital token that can be used on the blockchain. Fractionalizing lets users to divide the ownership of a token into smaller fractions, so multiple people can own one property.

It’s thought using the blockchain to tokenize and fractionalize will make it easier for more people to access global markets and real estate investment opportunities.

Supply chain – existing global supply chains are largely inefficient due to the complexity of tracking shipments. This can lead to errors in the supply chain, and leave businesses open to being exploited.

Blockchain can enable all assets in a supply chain to be efficiently and accurately tracked at every stage of the supply chain. The records cannot be tampered with or changed, leading to greater transparency.

These are just a few examples of industries that stand to benefit from blockchain as a result of the challenges they’re currently facing.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies, now including Polkadot

- Set conditional orders to control your trading

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.