Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Jamie Brew

When we look back at June 2023, the month showcased a rebound in several key metrics in the crypto market, largely triggered by the anticipation and impact of BTC spot ETF filings.

The bitcoin price hit a new 52-week high, peaking at over €31,000 and finishing the month above €30,000, a 9% increase. Similarly, centralized exchanges saw increased spot trading volumes, reflecting renewed market momentum and investor engagement. However, NFT marketplaces saw a slight decrease in activity.

Overall, June was filled with exciting advancements, regulatory developments, and growing engagement from significant institutions. So, let’s look at the numbers.

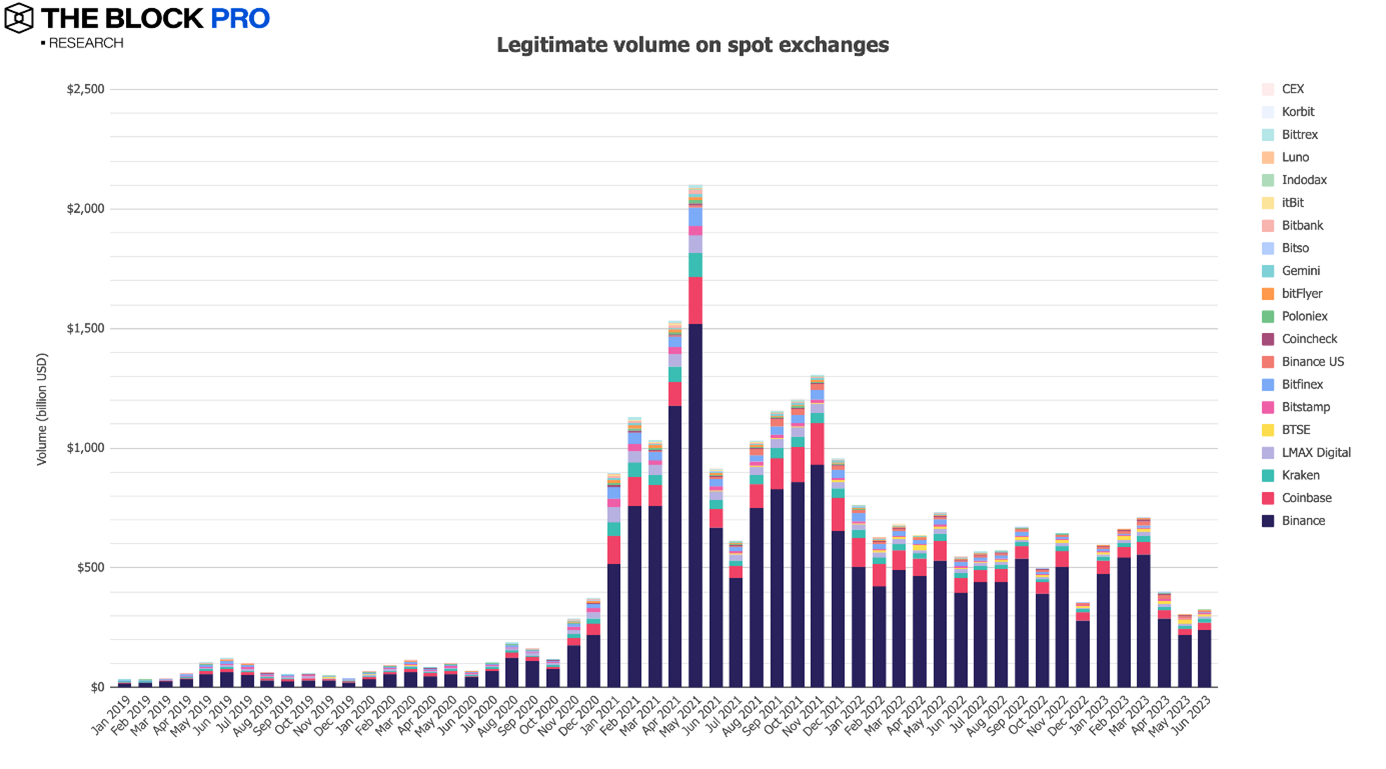

Spot volumes

Trading volumes for cryptocurrencies on the spot market increased by ~6%, with total spot volumes coming in at €325.5 billion, as reported by The Block’s legitimate volume index. Compared to May, this is an increase in total spot volumes of €25.5 billion.

Source: The Block Research

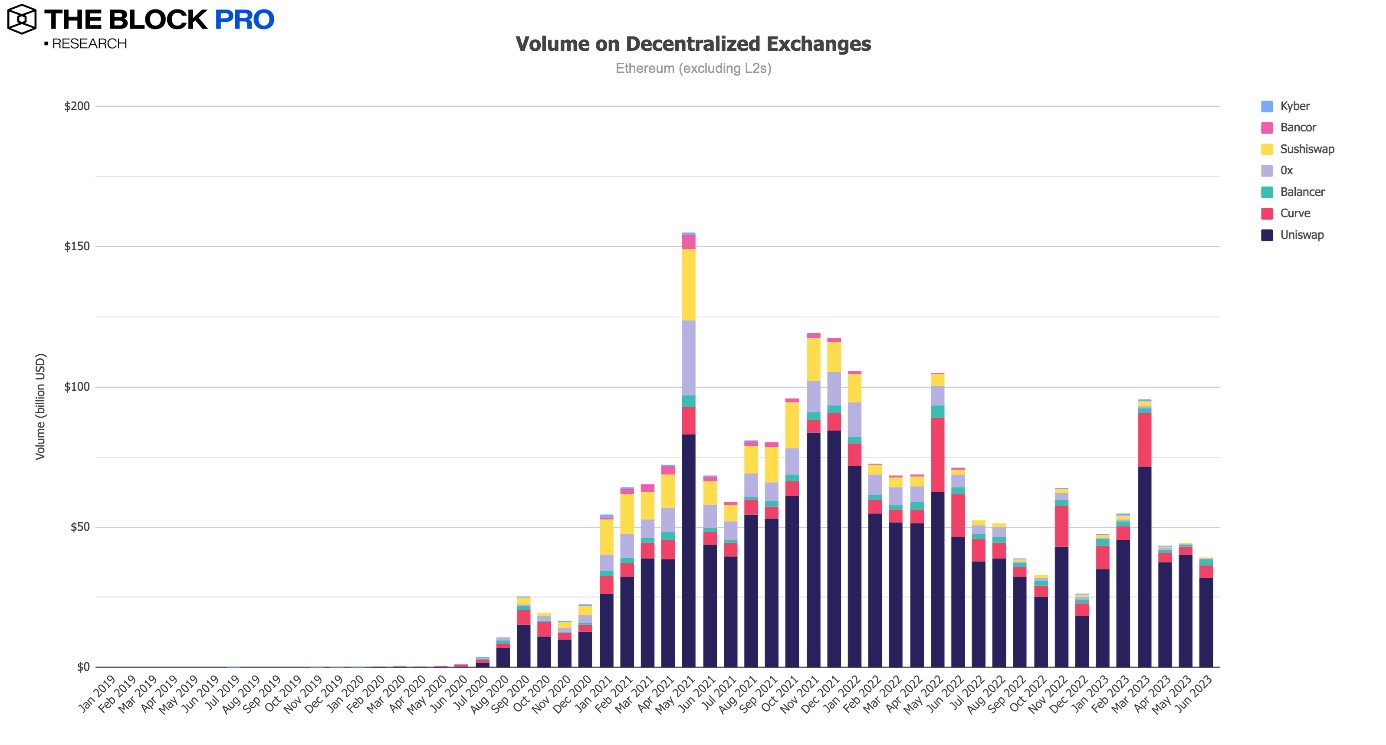

DeFi Volumes

The increase in spot volumes didn’t carry over to those seen on decentralized exchanges, where total volumes were ~€39 billion. Compared to May, volumes on Ethereum-based decentralized exchanges decreased by 11%.

Source: The Block Research

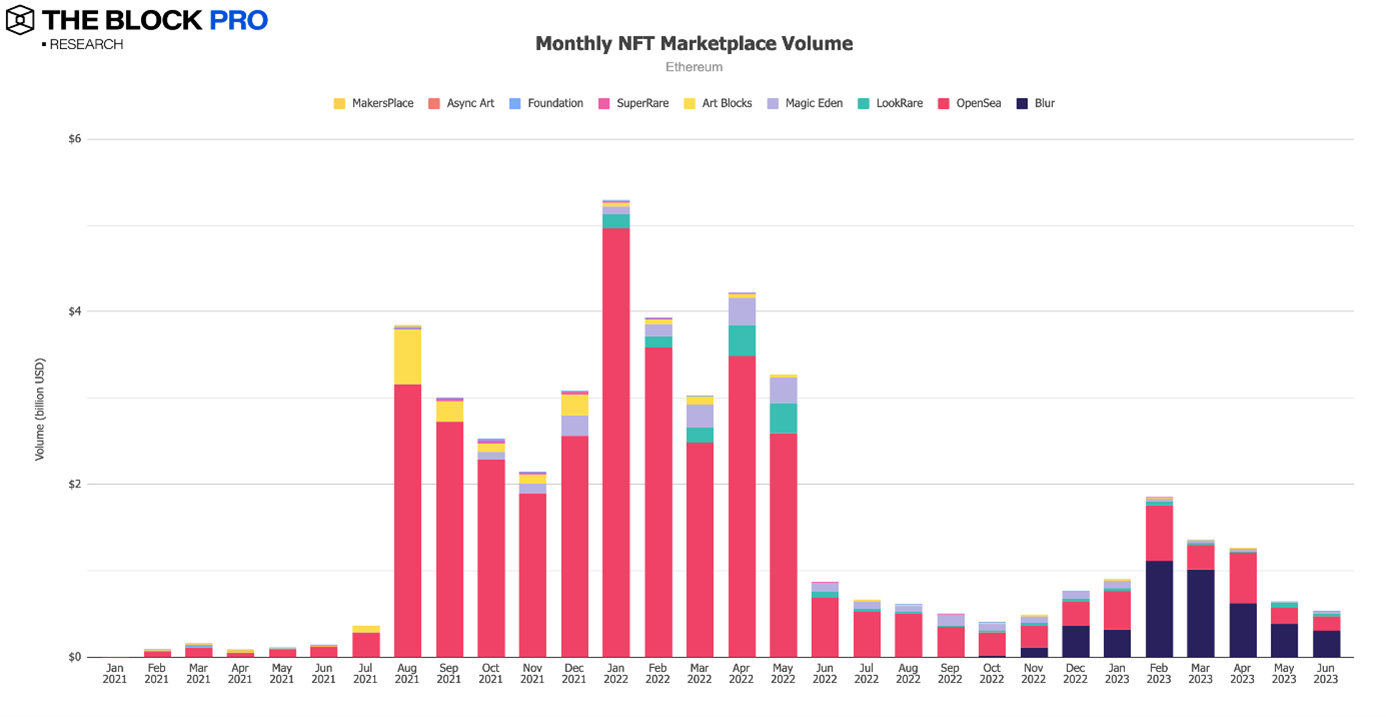

NFT performance and volumes

Following a similar trend to decentralized exchanges, volumes on NFT marketplaces decreased by 18% compared to May, with a total volume of ~€500m.

Source: CryptoArt, The Block Research

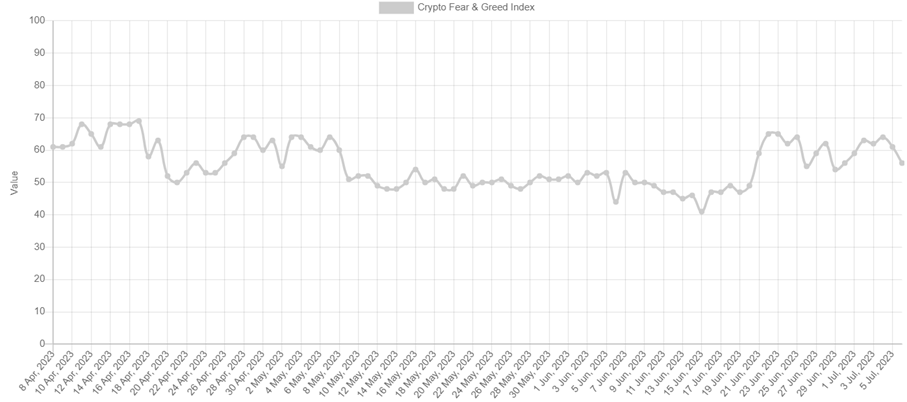

Market sentiment

A key indicator for market health is the Fear & Greed Index. In understanding that a score of 0 indicates ‘Extreme Fear’ and a score of 100 indicates ‘Extreme Greed’, in June the score reached 52 – which is ‘Neutral’. If we compare this to the sentiment score at the end of May, which was 59, market sentiment has dropped in June.

For additional context, extreme fear indicates that the general sentiment is very low, with investors worried about the market situation.

Source: https://alternative.me/crypto/fear-and-greed-index/

At the other end of the scale, extreme greed suggests investors are becoming too greedy and the market could be due for a correction.

Typically, in a ‘Bear Market’ or ‘Crypto Winter’ the sentiment is ‘Extreme Fear’ and in a ‘Bull market’ the sentiment is ‘Extreme Greed’.

News recap

HSBC

The month started with HSBC acknowledging the significant potential of distributed ledger technology (DLT) in revolutionizing cross-border payments.

In a document titled "Distributed Ledger Technology in the Capital Markets Game Changers - Future Trends in Securities Services," HSBC specifically highlighted the capabilities of the XRP Ledger (XRPL). This acknowledgement was shared by Edward Farina, Head of Social Adoption at XRPHealthcare (XRPH), on Twitter and revealed HSBC's recognition of DLT as a game changer in the financial industry.

HSBC emphasized the applications of DLT, particularly in the payments sector, highlighting its ability to facilitate secure, real-time, and cost-effective cross-border settlements using the XRP Ledger. This recognition demonstrates HSBC's understanding of the transformative power of DLT and its potential to reshape the capital markets and payment landscape.

Nike

Nike's foray into the world of non-fungible tokens (NFTs) takes a new turn as recent reports suggest that their NFT marketplace, .Swoosh, will be integrated into upcoming EA Sports video games. While the specific titles have not been disclosed, EA Sports is well-known for its sports-related games like FIFA. Nike plans to reveal more details on how their NFTs, termed "virtual creations," will be incorporated into EA's games shortly.

This partnership is part of Nike's ongoing embrace of Web3 technology, with the aim to offer unique experiences to both the .Swoosh community and the extensive fan base of EA Sports. They launched on Polygon in November 2022 with the .Swoosh platform enabling users to trade NFTs, access tangible products, and attend events.

Already collaborating with renowned athletes like Cristiano Ronaldo, LeBron James, Michael Jordan, and Serena Williams, .Swoosh achieved success with its debut NFT sneaker collection, Our Force 1, which saw over 97,000 units sold to nearly 53,000 addresses.

Circle

Circle, the issuer of the USDC stablecoin, secured a Major Payment Institution (MPI) license from the Monetary Authority of Singapore. The license granted its affiliate, Circle Internet Singapore, permission to offer digital payment token services and domestic/cross-border money transfers in Singapore.

This achievement is significant for the adoption of regulated and trusted dollar digital currencies in Singapore and the wider Asian region. Circle's recent establishment of an office in Singapore and collaboration with Tribe, a government-supported blockchain ecosystem builder, further reinforce their commitment to responsible financial services innovation and the development of financial infrastructure for digital currencies in the region.

Regulatory environment

The Securities and Exchange Commission (SEC) made significant moves in the crypto industry as it filed complaints against Coinbase and Binance.

Coinbase is facing a lawsuit from the SEC for alleged violations of securities laws. The SEC has identified multiple tokens as securities in the case against Coinbase.

Meanwhile, Binance, along with its founder Changpeng Zhao (CZ), was also charged by the SEC for multiple securities law violations. The SEC alleges that Binance allowed high-value U.S. customers to trade on Binance.com despite claiming restrictions and that CZ and Binance controlled Binance.US behind the scenes.

BlackRock

However, it was not all doom and gloom for the crypto market in June.

BlackRock, the world's largest asset manager with €8.6 trillion in AUM, took a significant step towards launching a spot bitcoin exchange-traded fund (ETF) by filing a registration statement with the Securities and Exchange Commission (SEC) for the iShares Bitcoin Trust. This potential ETF will primarily hold bitcoin assets through Coinbase Custody Trust Company and be benchmarked against the CME CF Bitcoin Reference Rate provided by CF Benchmarks, a subsidiary of Kraken.

BlackRock's objective with this proposed ETF is to offer a user-friendly and accessible investment option for the majority of Americans who have not yet owned Bitcoin, aiming to tap into the growing interest in cryptocurrencies. Notably, BlackRock has experienced success with ETF registrations, as only one out of 575 filings has been rejected in the past.

The BlackRock news led to a landslide of other large institutions submitting filings for Bitcoin Spot ETFs. In addition to BlackRock, Invesco, WisdomTree, and Valkyrie have joined the race by seeking approval for their respective cryptocurrency-linked products.

WisdomTree has filed for the WisdomTree Bitcoin Trust, while Invesco is pursuing approval for the Invesco Galaxy Bitcoin ETF. Both firms have previously faced rejections from the SEC for similar ETF attempts.

The SEC has thus far only approved bitcoin ETFs tied to U.S.-traded futures, citing concerns about market surveillance. Invesco's filing emphasized the unique lack of a spot exposure vehicle for Bitcoin in the U.S., distinguishing it from other major markets such as Canada and Brazil.

The growing number of filings demonstrates the increasing interest and demand for Bitcoin spot ETFs in the market. But further activity was seen from large institutions beyond Bitcoin Spot ETF filings.

The first is that EDX Markets, a crypto exchange supported by major players like Citadel Securities, Fidelity Investments, and Charles Schwab, officially launched. The exchange offers trading in bitcoin, ether, litecoin, and bitcoin cash.

Unlike traditional exchanges, EDX operates as a non-custodial platform for executing trades between cryptocurrencies and fiat currencies, prioritizing security by relying on third-party banks and a crypto custodian to hold customer assets. Although it caters to retail brokerages, EDX does not directly serve individual investors.

EDX is backed by Paradigm, Sequoia Capital, Virtu Financial, and new investors from its second funding round, including Miami International Holdings and affiliates of proprietary trading firms DV Trading, GTS, GSR, and Hudson River Trading.

Deutsche Bank AG

Deutsche Bank AG, the largest bank in Germany by total assets, applied for a digital assets license from Germany's financial regulator, BaFin. The bank aims to provide custody services for cryptocurrencies and other digital assets.

This strategic move is expected to increase fee revenue for Deutsche Bank's corporate bank unit. It aligned with the activities of its asset management subsidiary, DWS, which had been exploring investments in German crypto companies like Deutsche Digital Assets and Tradias to expand income and capitalize on the growth potential of digital assets.

This application represents a shift in Deutsche Bank's stance on digital assets, as the bank had previously expressed concerns about the volatility and reliability of Bitcoin as a store of value.

Coinbase

Coinbase released a research report called 'The State of Crypto: Corporate Adoption,' which suggested that the influence of the crypto space extends beyond exchanges and trading firms, with over 50% of Fortune 100 companies actively engaged in crypto projects since 2020.

The report highlights that 52% of these companies have invested in crypto or blockchain initiatives, with 70% having already reached the publicly launched stage by Q2 2023.

However, regulatory uncertainty and the lack of clear rules are still seen as significant barriers to widespread adoption, with companies emphasizing the importance of clear regulations to sustain the United States' leadership in the crypto industry.

The report also reveals substantial investments by Fortune 100 firms in crypto blockchain startups, with prominent participation from Citi Ventures, Google Ventures, Microsoft Ventures, and Goldman Sachs. While not the primary focus, the rise of non-fungible tokens (NFTs) is driving initiatives in the retail sector and expanding participation beyond technology and financial services.

Central Banks

The final piece of news was that central banks, including the Monetary Authority of Singapore (MAS), are collaborating with the International Monetary Fund (IMF) to propose standards for the use of digital money. The proposal encompasses central bank digital currencies (CBDCs) and tokenized bank deposits on distributed ledgers.

Developed in partnership with institutions like Banca d'Italia and the Bank of Korea, as well as financial institutions and fintech firms, the proposal introduces a common protocol that outlines the conditions for utilizing digital money.

In a related pilot project, Amazon, FAZZ, and Grab are testing escrow arrangements for online retail transactions, ensuring that payments are released to the merchant only after the customer receives the purchased items. The initiative addresses technical specifications, business models, and concerns regarding the programmability of digital money, underscoring the significance of preserving its role as a medium of exchange while avoiding the fragmentation of liquidity.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.