Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Jamie Brew

With January 2023 recently coming to a close, it's a good time to reflect on the state of the crypto market. If we look back to 2022, the year ended with a downward trend after contagion spread post FTX collapse. But the start of 2023 has shown signs that the market has started to recover.

Does the possible market rebound mark the end of the “crypto winter”? Let’s look at the numbers and recap the key events that took place in January.

Volumes

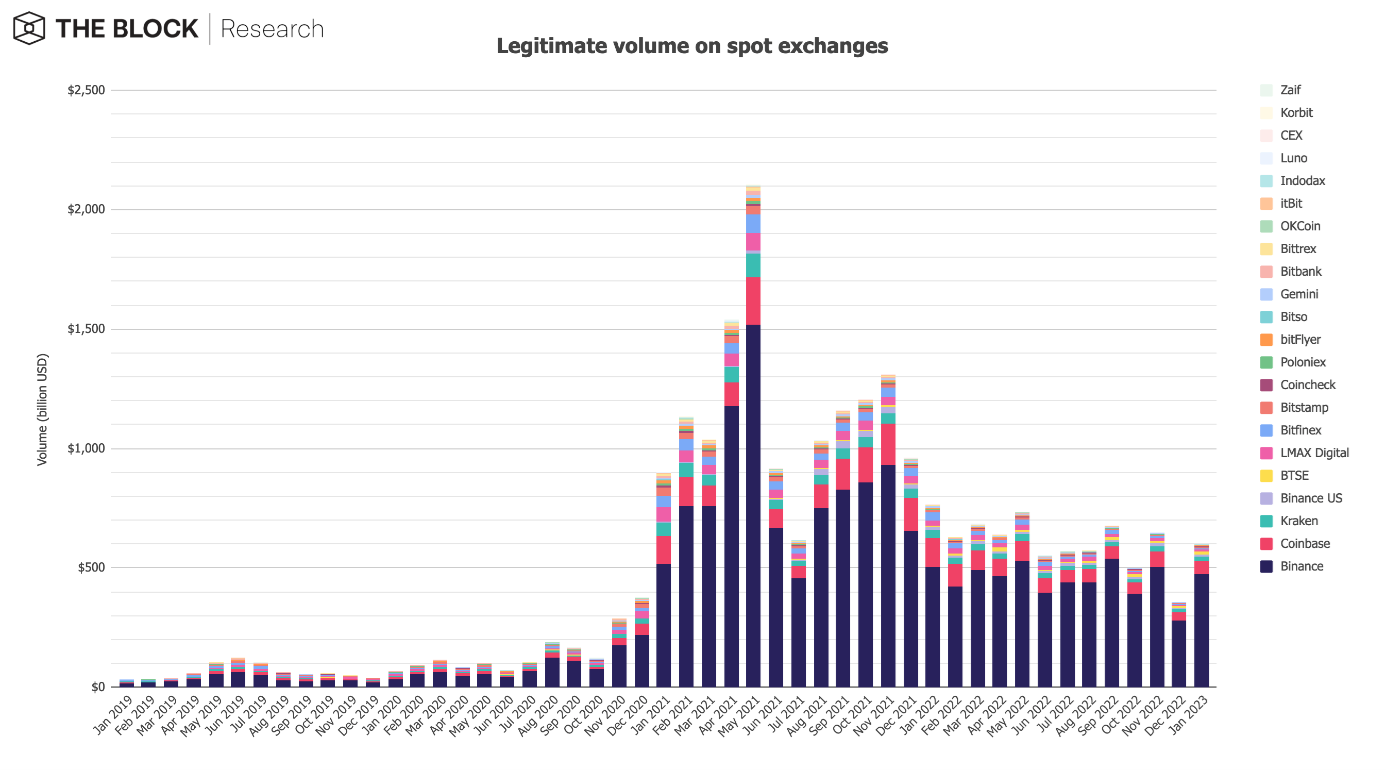

In January the market saw a positive performance across most metrics. Spot volumes actually increased by 67.2% in January to volumes of €597.6 billion. By comparison, December 2022 saw volumes of €357.5 billion according to the Block’s legitimate volume index.

Source: The Block Research

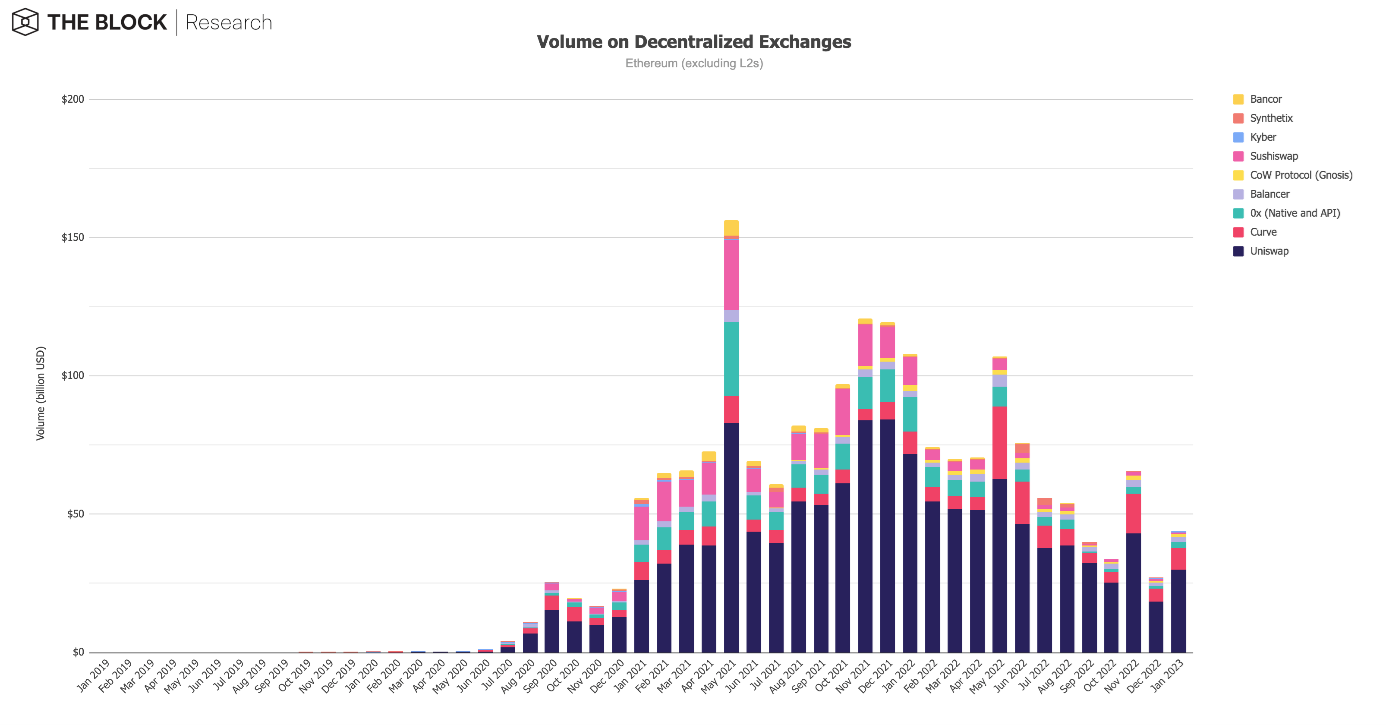

Similarly, volumes on decentralized exchanges increased in January, up 62.7% on December 2022 with a volume of €44.1 billion.

If we look back to November 2022, the volumes spiked both during and after the FTX collapse. However, centralized exchange volumes decreased in December as market sentiment was low.

Source: Dune Analytics, The Block Research

Crypto headlines

Mt. Gox

Mt. Gox, a Japanese crypto exchange launched in 2010 that filed for bankruptcy in 2014, is back in the headlines. This is because Mt. Gox creditors will have an extra two months to provide crypto exchange and banking details for repayments.

At one point, Mt. Gox was the only legitimate place to buy Bitcoin. Before Mt. Gox, Bitcoin was largely traded peer-to-peer, often in the form of a physical memory stick exchanges for cash.

Reportedly, Mt. Gox lost around 850,000 Bitcoins, worth around €460 million back in 2014. At the time of writing, this would be worth around €14 billion.

Since then, Mt. Gox has been working on a rehabilitation plan that was announced in 2021, with hopes to return a portion of the lost Bitcoin back to creditors.

These repayments were due to start this month. However, Mt. Gox announced a delay in repayments, citing that a significant number of creditors had yet to file their information.

Genesis Global

Genesis Global, a crypto lender, filed for bankruptcy protection. Reportedly, they warned investors that they would need to file for bankruptcy if they couldn’t line up sufficient financing.

Genesis Global Capital is the crypto lending unit of Digital Currency Group (DCG). Two months ago the firm halted withdrawals, including for customers of their Gemini Earn product. In total, Gemini Earn customers lost access to around €900 million worth of funds.

Genesis reportedly owes more than €3.6 billion to the top 50 creditors.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.