Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Lydia Pallot

There’s a famous saying about forecasting: “Never make predictions, especially about the future”. With only a quarter of the year behind us, crypto has reminded us of that wisdom, with competing themes pulling the market up and down without providing a convincing sense of direction. In the battle between positive and negative sentiments, these five narratives could play a key role in shaping the crypto market.

1. Can Bitcoin live up to its safe haven credentials?

According to Coinmarketcap, a crypto price aggregator, bitcoin’s price was around €16,600 at the start of 2023, €1k off a 52-week low, reflecting the broad sell-off experienced in 2022.

That market downturn has largely been filed under the label ‘credit crisis’ and was characterised by the failure of several high-profile centralised crypto services.

The individual circumstances are being played out in bankruptcy hearings and criminal proceedings, but a key catalyst was considered to be the rising interest rates designed to curb high inflation in the wider economy.

Critics have pointed out that these are the circumstances where Bitcoin is supposed to thrive. So, a key question for Bitcoin in 2023 is whether that will change.

The collapse over a matter of days in early March of Silvergate and Silicon Valley Bank morphed from a localised issue to something potentially more systemic to the financial system when quickly followed by the forced sale of Credit Suisse to rival UBS.

If this does become a widespread banking crisis, the US Federal Reserve may have to reverse course on interest rate hikes.

However, what would be significant is positive sentiment in Bitcoin against a continued banking crisis, falling stock market, and persistent inflation, which might suggest that it is finally starting to do what it says on the tin.

2. Regulatory clarity and a European focus

2023 has seen a noticeable increase in the actions brought by US regulators against businesses serving the crypto industry.

In March, a New York State regulator suggested ether (ETH) should be considered a security, a move that, if replicated, could have implications for altcoins, as a Coindesk article from March 9th explained.

“Ether has long been treated as a commodity by state and federal regulators, including the Commodity Futures Trading Commission (CFTC). Designating it as a security would have a massive impact on crypto markets, drastically changing how (and whether) the currency and others like it are traded in the U.S.”

Those comments reflected noises coming out of the Securities & Exchange Commission (SEC), but later in March, the U.S. Commodity Futures Trading Commission (CFTC) took action against Binance, suggesting it regarded ether as a commodity, alongside bitcoin (BTC), litecoin (LTC), tether (USDT) and Binance USD (BUSD).

If crypto is to move forward in 2023, clear rules are needed. The signs are that the EU, with the roll-out of the Markets in Crypto Assets (MiCA) framework, is likely to provide that clarity which could see a fundamental shift in focus to Europe.

3. One year until halving

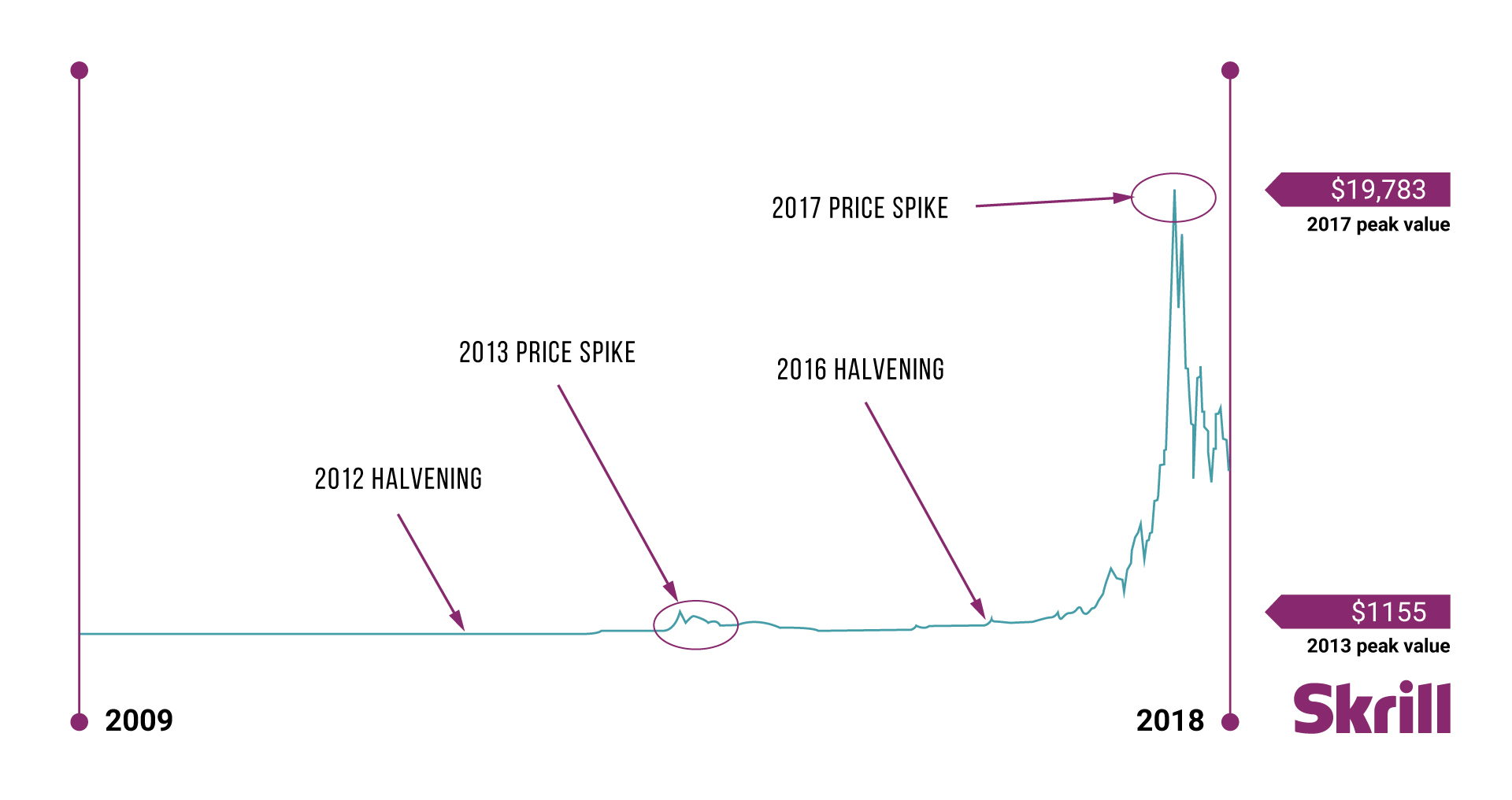

Every four years an event called ‘the halving’ takes place. The reward given to miners for adding new blocks to the Bitcoin blockchain is cut in half to keep its supply on a track for the pre-defined target of 21 million expected by the year 2140.

What isn’t certain, however, is how the market digests this knowledge and feeds into price. The next halving is forecasted to take place in April 2024 at block 840,000.

The broad pattern to date shows BTC higher at each halving, with a significant increase a year later. However, Bitcoin has only experienced three previous halvings, each within entirely different contexts, so nothing can be taken for granted.

|

|

Price At Halving |

Price One Year Later |

% Change |

Inflation Rate |

Reward |

|

Nov 28, 2012 |

$12.35 |

$1.042.01 |

+8,300% |

12.86% |

25 |

|

July 9, 2016 |

$653.03 |

$2,536.19 |

+288% |

4.39% |

12.5 |

|

May 11, 2020 |

$8,582.37 |

$56,546 |

+559% |

1.88% |

6.25 |

It might seem logical for widespread anticipation of the halving to drive up Bitcoin's price leading into April 2024 as scarcity increases. But the halving reduces rewards to miners by 50%, driving some out of business, which reduces the hash rate broadly correlating to price.

There can be no certainty of how Bitcoin’s price will respond to the halving, but we can be sure that it will be vigorously debated as that key four-year milestone approaches.

4. The diversification of stablecoins

The collapse of Terra (UST) last May sent shockwaves through the crypto ecosystem, which, almost a year on, are still being felt. Though the fate of algorithmic stablecoins seems highly uncertain, there’s no getting away from the important role stable currencies play in the crypto ecosystem as on/off ramps and for crypto traders to park their capital.

The three key stablecoin players jostling for position - Tether (USDT), Binance (BUSD) and Circle (USDC) - are all dollar-denominated.

The uncertain regulatory environment in the US is in contrast to Europe, where the MiCA framework, as it currently stands, is due to come into effect early 2024. MiCA will include guidance on how stablecoins will be regulated.

We are seeing signs that key players may shift focus to Europe due to its progressive regulatory environment. Circle, the issuers of USDC and EUROC (a Euro-backed stablecoin), announced on March 21st that they are setting up their European HQ in Paris.

Volumes for EUROC are tiny compared to the main dollar stablecoins; the same is true for all non-dollar stables. But if the center of crypto innovation moves to Europe, that might not remain the case much longer.

Much depends on the path of legislation in Europe and elsewhere. Crypto businesses may decide to play regulatory arbitrage to benefit from the most friendly legal environment.

In the short term, however, stablecoins backed by currencies other than the USD will likely play a more important role in the crypto ecosystem than they now do.

5. The continued focus on innovation

Following the announcement of the Bitcoin Ordinals update in January 2023, allowing it to support inscriptions – the equivalent of non-fungible tokens (NFTs) – collections began minting. The minting included 10,000 Bitcoin Punks, with Yuga Labs closing its first-ever auction of Ordinal-based NFTs on March 7th.

The ‘TwelveFold’ collection saw €16.4 million of volume in 24 hours, highlighting the depth of interest in the Bitcoin version of NFTs.

Though there isn’t universal agreement in the Bitcoin community on the value of Ordinals, attitudes could change as NFT use cases increase.

In late March, Ticketmaster announced a trial of NFTs providing a gated-ticketing service to combat scalping (a fast-paced trading strategy that depends on small price movements to make profit). If NFT usage for ticketing at music or sporting events catches on, wider adoption could follow.

At a broader level, much of the promise of web3 relies on improvements in how users can engage with internet services without losing privacy. Concepts like account abstraction and Soulbound tokens could enable that.

And last, but by no means least, let’s look to Artificial Intelligence (AI). Blockchain-based protocols may start leveraging AI to feed a wide range of actionable insights into Smart Contracts, this could range from automating portfolio management, optimising healthcare alerts or improving supply chain functions.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.