Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Since the publication of the Bitcoin Whitepaper in 2009 by Satoshi Nakamoto (a pseudonym for the unknown author), the world has witnessed the creation and development of a new class of financial assets: cryptocurrencies.

Even though the history of cryptocurrencies is relatively short, in just over a decade they have generated immense interest to the point that their current market capitalisation is 1.2 trillion euros.

If you’ve considered investing in cryptocurrencies, but are wondering which cryptocurrency to buy, then this is the article for you. Here we will discuss some factors to consider before you make the decision to buy cryptocurrencies, and how a Skrill account can help you.

Four factors to consider before buying cryptocurrencies with Skrill

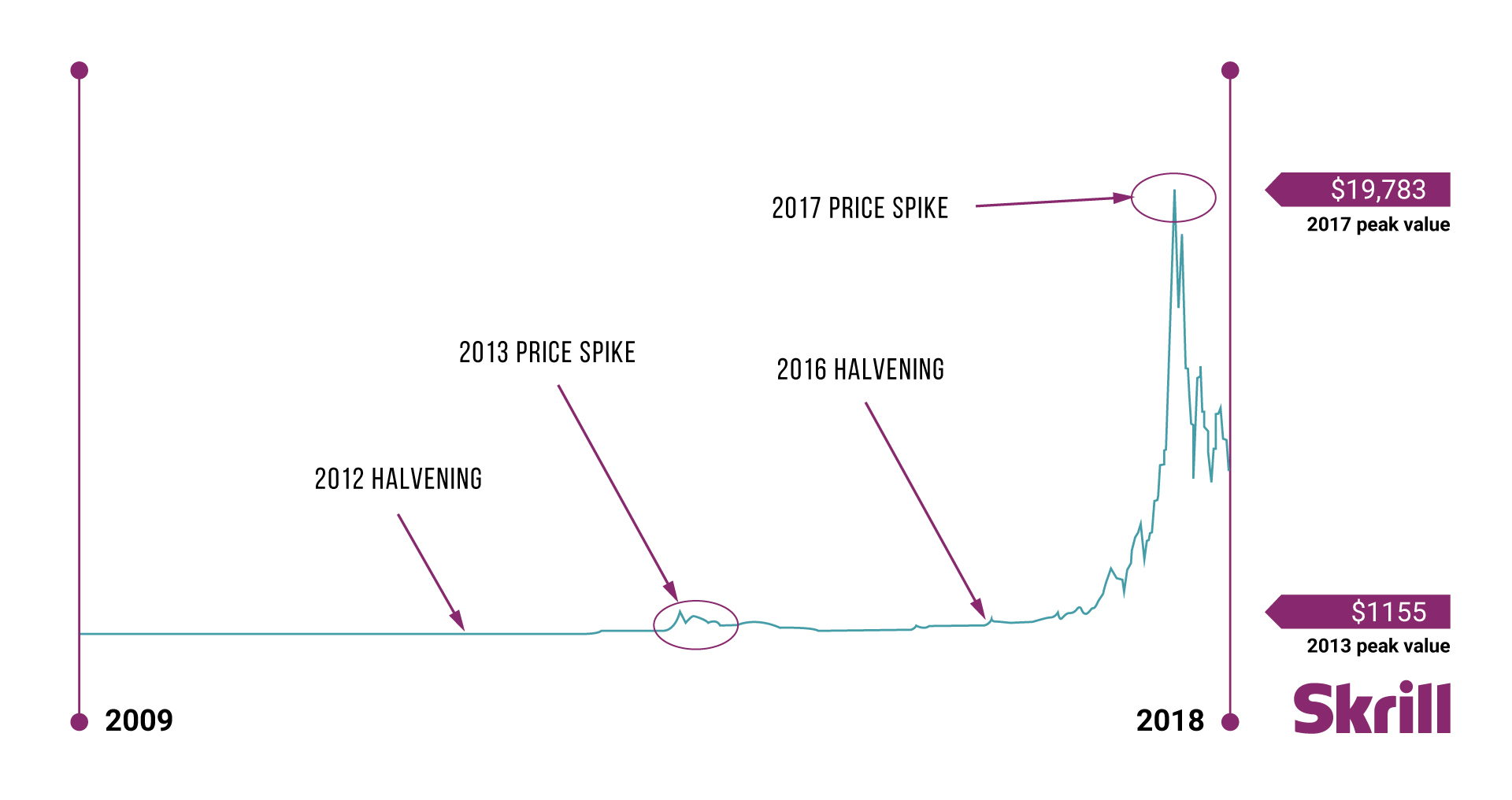

1. Managing expectations: Although the rise of cryptocurrencies has created millionaires, it has also led many investors to substantial losses. For instance, in 2018, bitcoin experienced an 80% drop in its value in a single year. It is essential to understand that cryptocurrencies are a high-risk investment type, often with volatility far exceeding traditional markets. Therefore, you must be emotionally and financially prepared for such fluctuations.

2. Understanding how trading works: If you are new to cryptocurrency investing, it is vital that you take the time to understand how trading platforms work.

When buying cryptocurrencies, you need a wallet for cryptocurrencies to safely store your assets. From here, a crucial decision arises: whether you prefer to use a cryptocurrency exchange or a broker.

An exchange allows you to buy and sell cryptocurrencies directly. Whereas a broker such as Skrill facilitates these transactions on your behalf. The advantage of buying cryptocurrencies with Skrill is that it offers an easy-to-use platform that eliminates many of the complexities associated with exchanges.

3. Deciding which strategy you want to implement: When investing in cryptocurrencies, it is crucial to have a well-defined strategy.

Some investors choose to HODL, which involves buying and holding a cryptocurrency long term, regardless of market fluctuations. This strategy is based on the belief that the value of cryptocurrencies will increase over time.

On the other hand, some investors prefer active trading, which involves frequently buying and selling cryptocurrencies to take advantage of market fluctuations; when it comes to this, Skrill lets you always see the live cryptocurrency price.

4. Learn the wider implications: Besides understanding the basics of cryptocurrency trading, it’s also important to consider the tax implications of investing in cryptocurrencies.

In many countries, gains from the sale of cryptocurrencies are taxable, and it is the user’s responsibility to report these gains on their tax return. Non-compliance can lead to significant penalties, so it is advisable to seek professional tax advice if you are about to invest a significant amount of money in cryptocurrencies.

In summary, the world of cryptocurrencies can be complex and volatile. Before venturing to buy cryptocurrencies and opening a Skrill wallet, it is vital that you take the time to understand how cryptocurrency trading works, have a clear strategy, and be aware of the tax implications. Only risk what you can afford to lose.

If you want to learn more about cryptocurrencies, check out the Skrill Crypto Academy. Or, if you’re ready to start trading, you can create a Skrill account here. In your Skrill digital wallet, you can choose from over 40 cryptocurrencies to buy and sell.