Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Jamie Brew

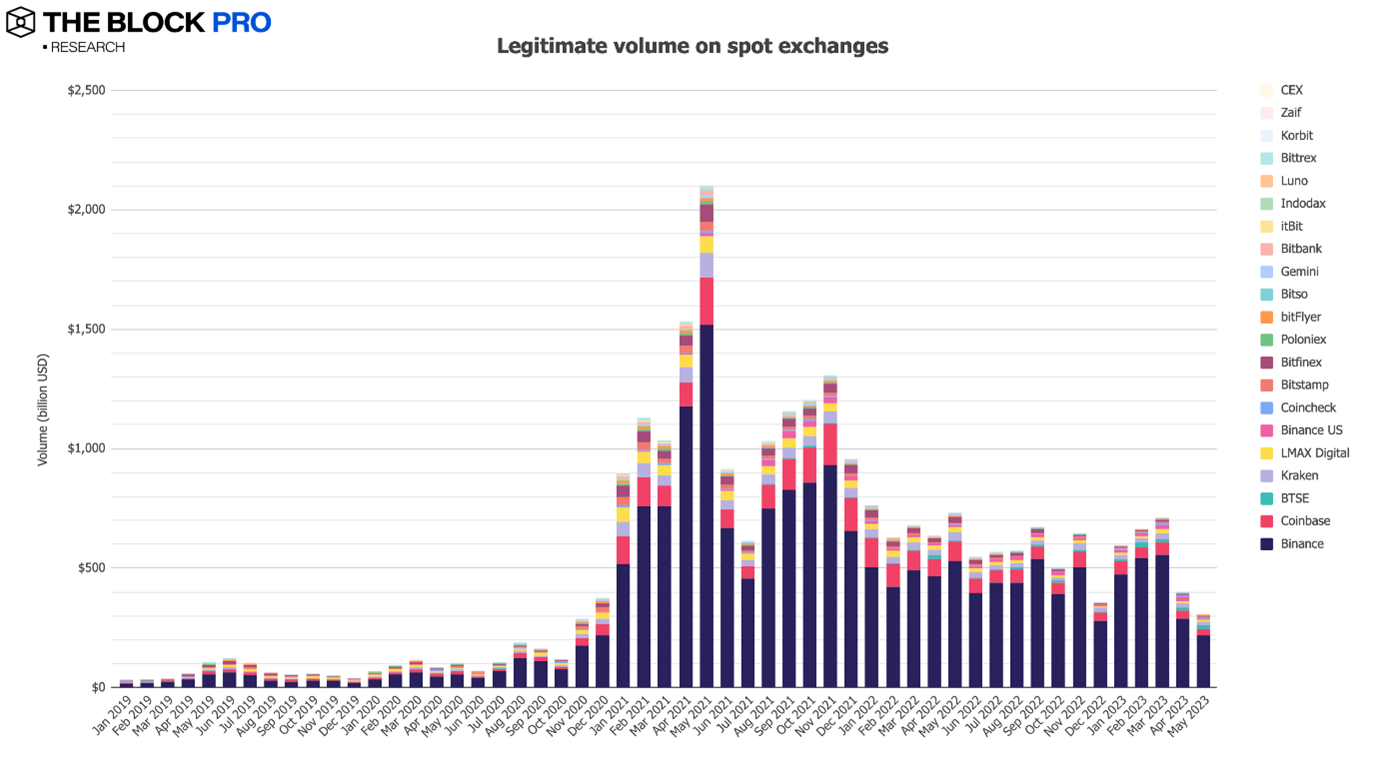

April was the first month of 2023 with a reduction in spot trade volume, and it was a significant drop of 40%. Would May continue this downward trend, or would it rebound to continue the upward trend seen in Q1? Unfortunately, further reductions in spot trading volumes were seen in May, over 23% (compared to April), according to data from Theblock.

What were the main reasons behind this sharp drop in spot trading volumes in May? This article will highlight the key news headlines over the past month that might have influenced such a reduction in volume.

Spot Volumes

In May, the trading volumes for cryptocurrencies on the spot market decreased by 23.2%, as reported by The Block’s legitimate volume index. The total spot volume for May came in at $307.4 billion. In contrast, the April spot volume was slightly over $400 billion. These were the lowest spot trading volume numbers since December 2021 and a 57% reduction from the 2023 highs in March.

Source: The Block Research

DeFi Volumes

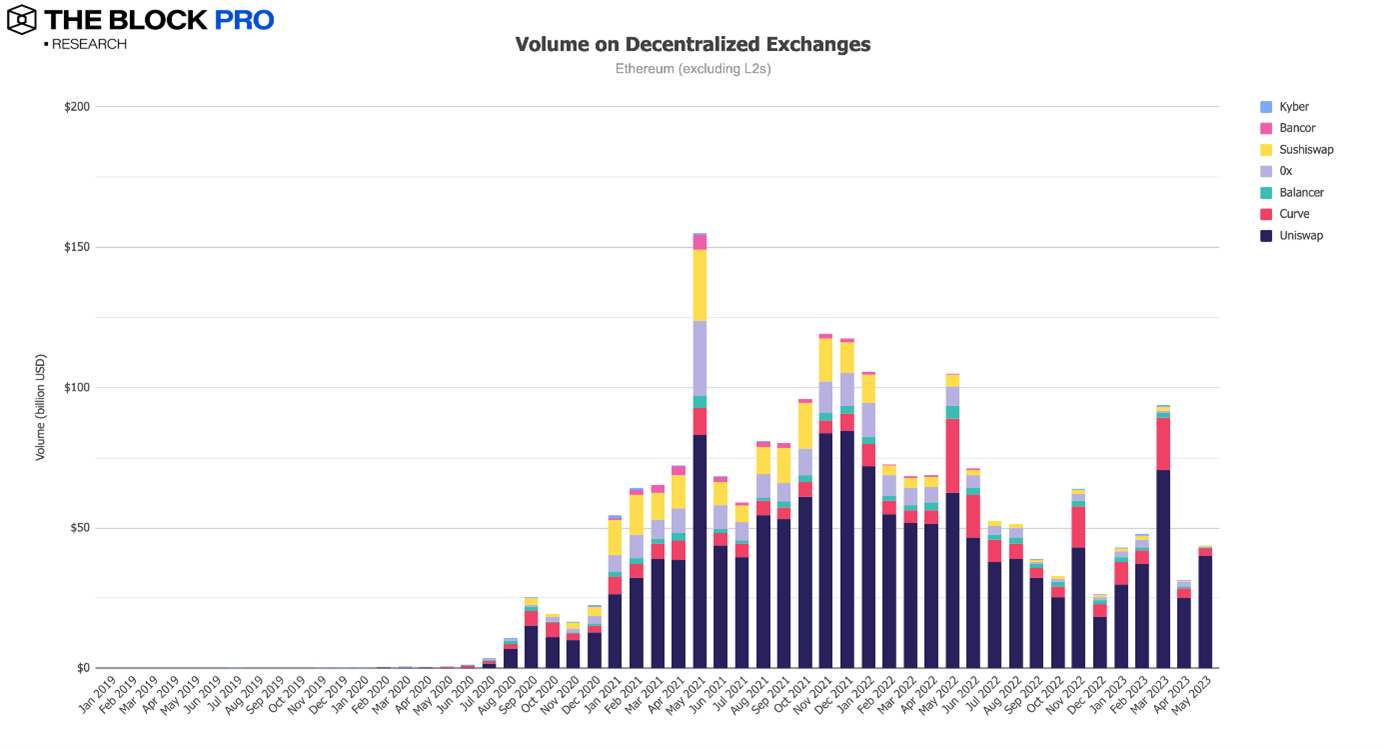

On a brighter note, the volumes on Ethereum-based Decentralized Exchanges increased by 34.4% in May compared to April. The May volume was over $48 billion on Decentralized Exchanges, the third highest in 2023, and due to this, the ratio between Decentralized Exchanges and Centralized Exchanges increased to 14.3%.

Source: The Block Research

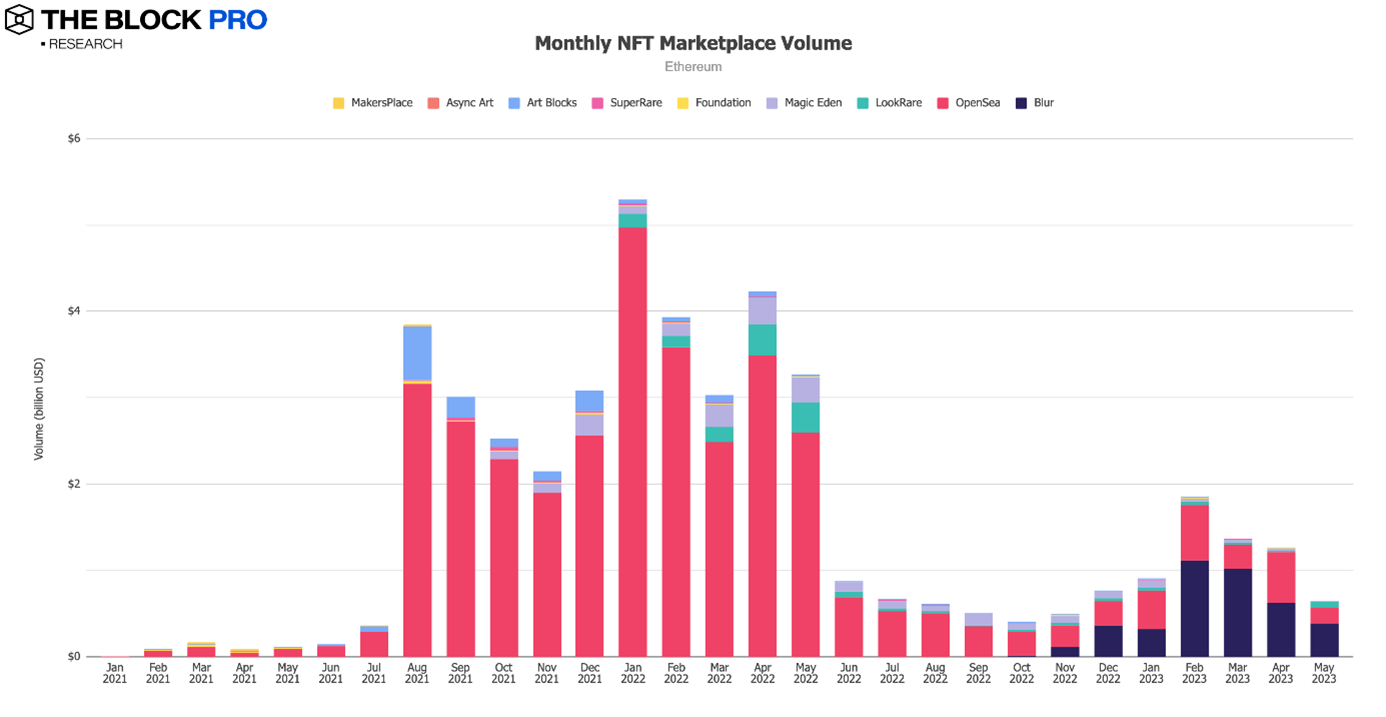

NFT performance and Volumes

In contrast to the volumes on Decentralized Exchanges, the volumes on NFT marketplaces recorded their lowest volume in 2023 in May and the lowest since last November. Blur managed to claw back market share from OpenSea, recording over 59% market share. In April, it looked like OpenSea was regaining market share with the launch of its Pro platform when it recorded 47% of the NFT volume. However, this reduced to 28% in May.

Source: CryptoArt, The Block Research

Market Sentiment

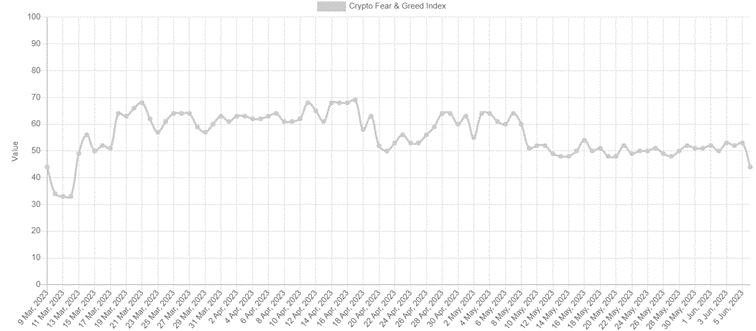

Another indicator for the market health is the Fear & Greed Index and how it developed in May. At the beginning of May, the score was 63 – which is Greed. What does that mean? Well, if the score was 0, that would indicate “Extreme Fear” meaning that the general sentiment is extremely low and investors are worried about the market situation.

If the score was 100, that would indicate “Extreme Greed” meaning that investors are becoming too greedy and the market could be due for a correction. Usually in a “Bear Market” or “Crypto Winter” the sentiment is “Extreme Fear” and in a “Bull market” the sentiment is usually “Extreme Greed”. By the end of May, the market sentiment score was 51 - which is “Neutral” showing a reduction in the market sentiment in May.

Source: alternative.me/crypto/fear-and-greed-index/

News recap

The month started with announcements from the two major payment networks, Visa and Mastercard. Visa intends to embrace stablecoin payments as part of its ambitious cryptocurrency roadmap. To facilitate the adoption of public blockchains and stablecoins, Visa is actively seeking skilled crypto developers who share their vision. Specifically, they seek backend developers proficient in public blockchains and experienced in utilizing advanced AI tools like Github Copilot for smart contract development and debugging. Candidates with a passion for Web3 technologies are highly preferred. Cuy Sheffield, Visa's Vice President and Head of Crypto, announced the job opportunities on Twitter, emphasizing the company's commitment to driving mainstream adoption of public blockchain networks and stablecoin payments.

Mastercard teamed up with several blockchains and wallet providers to establish "Crypto Credential," a set of standards to foster trust within the blockchain ecosystem for individuals, enterprises, and governments. These standards will verify trustworthy interactions on public blockchain networks while accommodating diverse verification needs. By setting clear standards, Mastercard intends to enable individuals who meet the defined criteria to engage seamlessly across web3 environments. This partnership demonstrates Mastercard's increasing investment and interest in the cryptocurrency industry, underscoring its recognition of the sector's potential for growth and innovation.

Paypal extended their crypto transfers product to Venmo and their 60 million strong customer base. This new feature follows PayPal's introduction of crypto transfers on its platform last year. Additionally, users can transfer cryptocurrencies to their PayPal accounts, including external wallets held by other PayPal customers. This move by PayPal reflects a rising acceptance of digital currencies as a legitimate payment method amidst increased scrutiny of the crypto industry in the United States. PayPal acquired Venmo as part of its Braintree acquisition in 2013.

Stripe introduced a fiat-to-crypto on-ramp solution to tackle the "cold start problem" faced by Web3 companies, where customers may not have cryptocurrency readily available in their wallets. This hosted on-ramp service by Stripe enables customers in the United States to purchase cryptocurrencies without the need for any coding integration on their websites or apps. Stripe will handle various compliance tasks for Web3 companies utilizing the on-ramp, including conversion and authorization optimization, identity verification, and fraud prevention.

Sports Illustrated's ticketing site, SI Tickets, joined forces with ConsenSys to develop a new ticketing platform called "Box Office." Built on the Polygon blockchain, the platform aims to challenge established industry players like Ticketmaster, Live Nation, and Eventbrite. Box Office will introduce NFT ticketing, allowing event organizers to offer collectibles and loyalty benefits to attendees. It will also facilitate ticket resales on secondary markets while providing event hosts with a larger share of profits. The platform promises cost savings of up to 50% compared to competitors and the potential for increased revenue through monetizing ticket resales. CEO David Lane believes that blockchain represents the future of ticketing, offering a more advanced and engaging experience for all stakeholders involved.

During the Monaco Formula One Grand Prix, the largest ticket operator for Grand Prix events partnered with an NFT marketplace and a web3 firm to launch a new platform. The platform introduced an NFT ticketing system, allowing attendees to receive NFT tickets issued on the Polygon blockchain. By leveraging the security of Ethereum and the uniqueness of NFTs, the platform aims to enhance ticket authenticity and prevent counterfeiting. The collaboration involves NFT marketplace Elemint, Web3 firm Bary, and Platinium Group, the major ticket operator for Formula One Grand Prix events. This development highlights the expanding use cases for NFTs in the sports industry and offers attendees lasting digital mementos. Moreover, the NFT tickets may provide future benefits, such as post-race experiences or ticket discounts for upcoming Grand Prix events.

Coinbase introduced its subscription product, Coinbase One, to the UK, Germany, and Ireland. The subscription offers users the benefit of zero fees on every trade in exchange for a monthly payment of $29.99. In addition to fee-free trading, Coinbase One subscribers will receive round-the-clock customer support, enhanced staking rewards, and access to introductory offers for crypto data services.

Coinbase has been trying to move away from its reliance on the retail market by adding new non-transaction-based products. Coinbase One provides Coinbase with a more stable revenue stream as it does not rely as heavily on market sentiment, macroeconomic factors or any other external factor that would affect global trading volumes.

Ledger, a prominent crypto hardware wallet provider, faced significant backlash from crypto investors on social media after unveiling a new tool called Ledger Recover. The tool allows users to subscribe and split their seed phrase into three encrypted shards, which are then sent to third-party companies for safekeeping. Combining and decrypting these shards can reconstruct the original seed phrase. However, introducing this feature has raised concerns among security experts and Ledger owners, leading to an adverse reaction online. The Ledger Recovery service will be offered at a monthly fee of $9.99 and will involve three custodians: Ledger, Coincover, and EscrowTech. Initially available in select countries, including the US, UK, EU, and Canada, the service has plans for future expansion.

Also in May, according to Bloomberg, Jane Street Group and Jump Crypto, two prominent market makers in the cryptocurrency space, have expressed their intentions to scale back their involvement in crypto-related activities. Jane Street is planning to decrease its global cryptocurrency operations, while Jump Crypto aims to reduce its focus on the US crypto market and instead prioritize international expansion efforts.

The US banking sector experienced further turbulence in May as the failed bank First Republic had to be sold to JPMorgan Chase (JPM). During JPMorgan's Investor Day event, CEO Jamie Dimon cautioned investors to brace themselves for potentially higher interest rates of around 6% or 7%. Such an increase could lead to tighter credit conditions and exert additional pressure on bank loan portfolios.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.