Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Jamie Brew

For the most part, February continued the positive trends seen in January with increased volumes across NFT marketplaces, centralized spot, and decentralized exchanges. However, the adjusted on-chain volume of stablecoins decreased, where ‘on-chain’ refers to the cryptocurrency transactions made on the blockchain itself.

Before we dive into the various headlines seen throughout February, let’s review the numbers.

Volumes

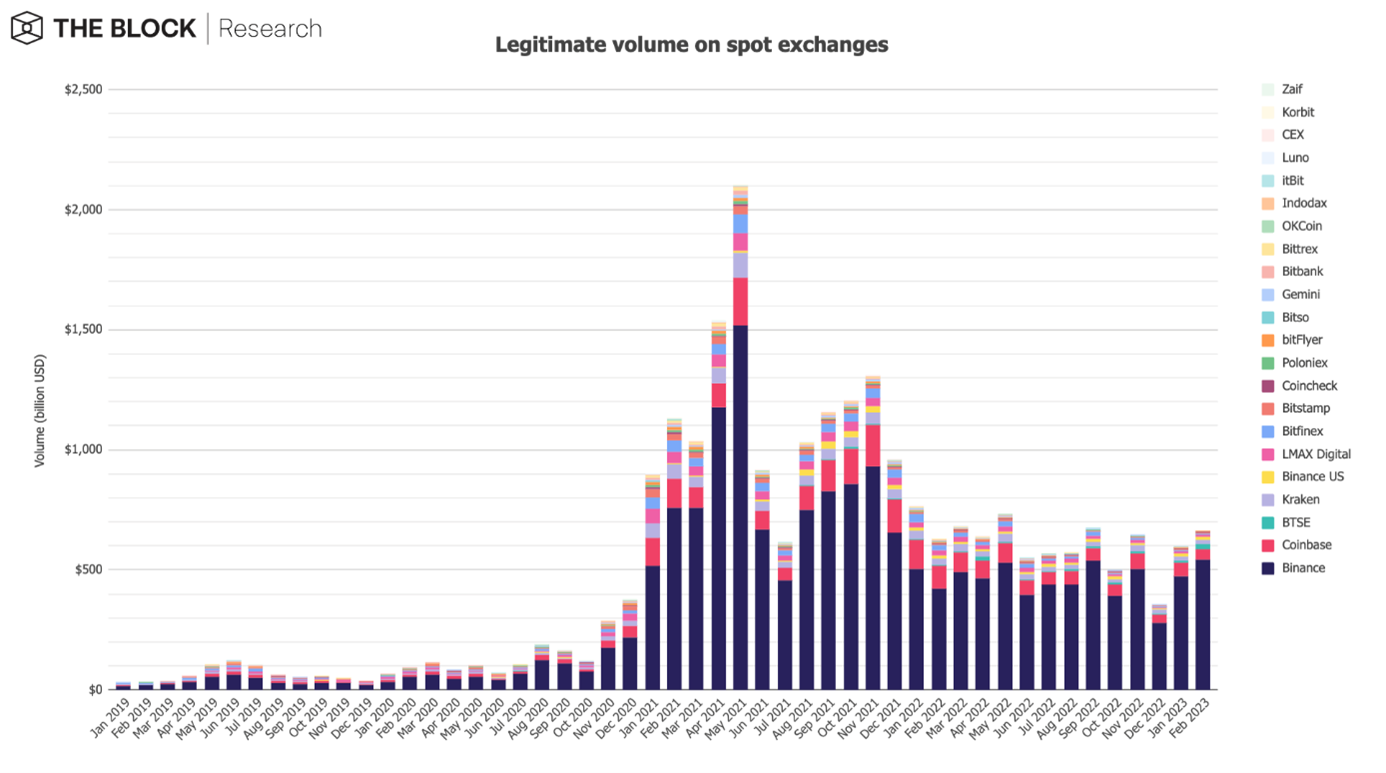

As mentioned, the market saw positive performance across some metrics but not all. The first positive metric was spot volumes. According to The Block's legitimate volume index, the volume for February hit $665.8 billion, compared to $597.6 billion in January, an increase of 11.4%. The volumes are back to similar volumes that we were seeing in early 2022 and on an upwards trend since December 2022, increasing by 86.2%.

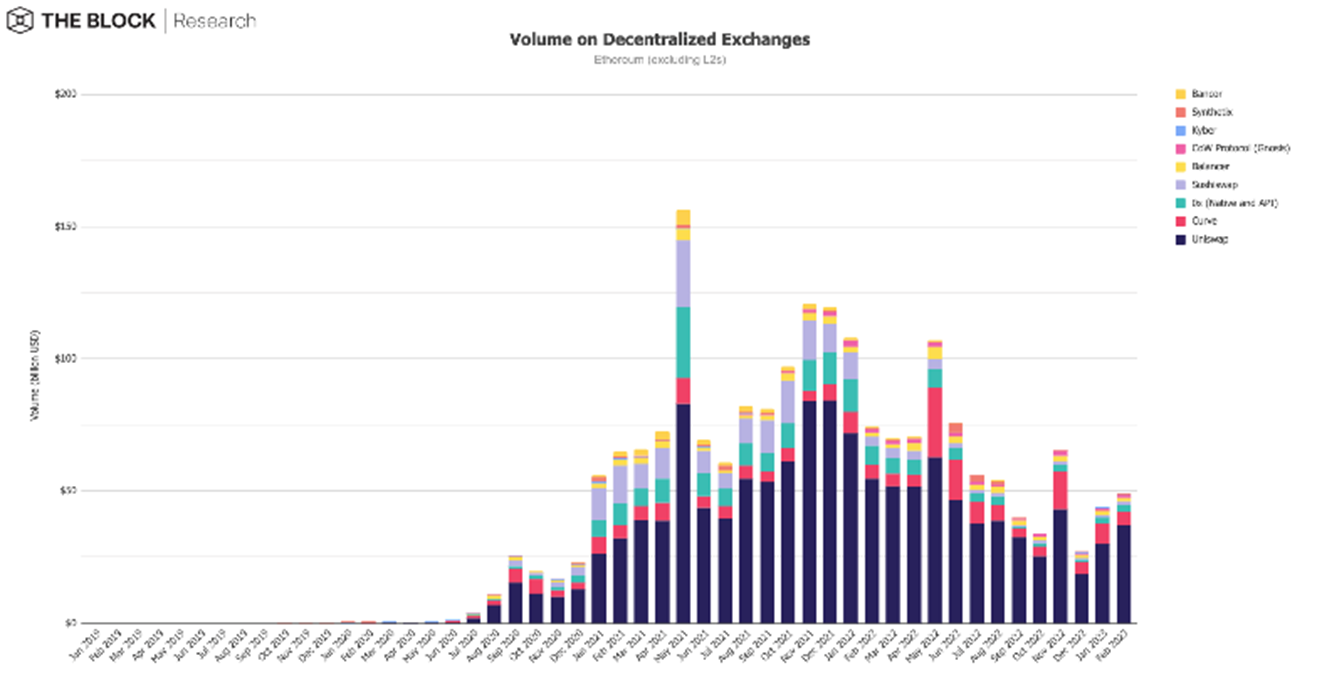

Almost one-to-one to centralized spot, the volumes on Ethereum based decentralized exchanges saw an increase of 10.9% in February compared to January. The volumes were $48.9 billion and $44.1 billion, respectively. The volumes are still lower than November, which was during the collapse of FTX. However, like centralized spot exchange volume, the decentralized volume is currently on an upwards trend.

Source: Dune Analytics, The Block Research

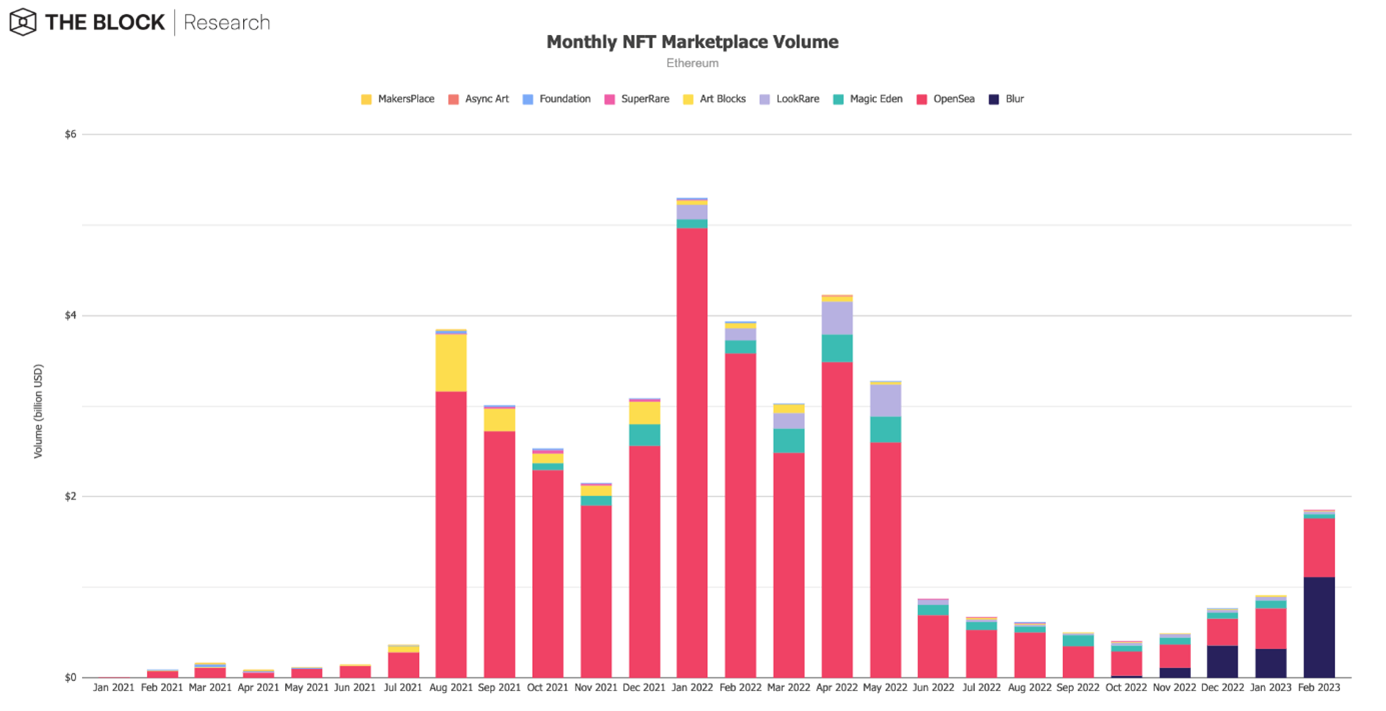

Positive trends can also be seen in the Non-fungible token (NFT) market. NFT marketplaces on Ethereum alone saw a monthly increase of 103.2%, with volumes in February hitting $1.855 billion.

For the first time OpenSea was displaced as the number one marketplace, overtaken by Blur who have increased its market share consistently since launching in October 2022.

The overall NFT Marketplace volume is still far lower than the peaks during the first half of 2022, but the upwards trend is a positive one. Whether it will remain is the question.

Source: CryptoArt, Dune Analytics, The Block Research

Market Sentiment

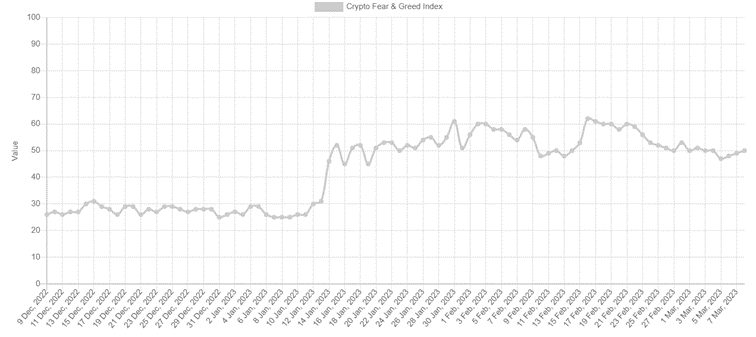

Another indicator for the market health is the Fear & Greed Index. This index assesses the dominant mood on the market, meaning the emotional and psychological factors are taken into consideration. At the beginning of February, the score was 56 – which is Greed. But what does this mean? Well, if the score was 0, that would indicate “Extreme Fear” meaning that the general sentiment is extremely low, and investors are worried about the market situation. If the score was 100, that would indicate “Extreme Greed” meaning investors are becoming too greedy and the market could be due for a correction. Usually in a “Bear Market” or “Crypto Winter” the sentiment is “Extreme Fear” and in a “Bull market” the sentiment is typically “Extreme Greed”.

By the end of February, the market sentiment score was 53% - which is “Neutral”.

The sentiment remained stable in February, floating between 50 and 60. For reference, the score at the start of January was 26 which is “Fear”, showing signs of market recovery since the turn of the year.

News recap

Sorare:

Announced at the beginning of February, Premier League Football teamed up with virtual sports gaming firm Sorare. The four-year licensing partnership is valued at around $150 million and allows fans to build their own teams with digital collectibles to compete in Sorare’s digital fantasy football game.

The Premier League has annual viewership figures more than 4.7 billion, and their free to use Fantasy Premier League has over 10 million players. It’s Sorare’s third major sports partnership having previously partnered with the National Basketball Association (NBA) and the Major League Baseball (MLB).

But what is Sorare? Think of it as having the classic physical trading cards, but on a blockchain. Players can create teams with the cards they’ve collected and earn points based on their players’ real-life performances. In turn, these points can then be turned into rewards such as;

-

Sorare cards

-

ETH

-

Special items like signed football jerseys, Sorare merch, or once-in-a-lifetime in-person experiences.

Blur and OpenSea:

Continuing the topic of NFTs, Blur displaced OpenSea as the number 1 Ethereum NFT Marketplace, by volume, in February. Blur incentivized the usage of its marketplace by promising users an airdrop of its token BLUR. The initial airdrop of 360 million BLUR was executed on 14th February, with the claim rate being close to 100%. Following the success, Blur plan to reward users further by carrying out a second airdrop, this time of around 300 million BLUR.

Since Blur launched back in October 2022, Blur and OpenSea have been competing for market share. The key focus has been around the application of creator royalty fees. Initially, Blur stayed away from charging full royalties, meaning they didn’t enforce a fee for creators to collect upon secondary sales of their digital collectibles. Instead, they left the option to buyers to decide whether to honour an artist’s royalty policy. It then changed tack by expanding royalties with a minimum fee of 0.5%.

However, Blur have now said that if NFT creators want to request full royalty fees, they can do so, provided they block their collection on OpenSea. This option isn’t a default setting and users will have to opt in for it. OpenSea responded with a similar action, only enforcing a 0.5% mandatory creator royalty fee on NFT trades for projects that don’t have an on-chain enforcement method. However, sellers can choose to pay a larger percentage.

Genesis Global:

Building on from January’s update, where Genesis Global filed for bankruptcy, the most impacted were users of the Gemini Earn program. Gemini Earn allowed users to receive interest on their assets that Gemini loaned to Genesis. This totalled around $900 million of Gemini user assets.

On the 7th of February Genesis announced they’d reached an agreement with Gemini and other creditors on a restructuring plan. As part of the agreement, Gemini are contributing $100 million in additional funds to users of the Earn product. The terms also include a sale of Genesis Global Trading. Gemini CEO Cameron Winklevoss stated that the agreement “provides a path for Earn users to recover their assets.”

Siemens:

Technology giant, Siemens became one of the first companies in Germany to issue a bond on a public blockchain instead of through traditional methods. The bond itself is worth €60 million ($64 million) and, in accordance with Germany’s Electronic Securities Act, has a maturity of one year.

The bond was sold directly to investors including; DekaBank, DZ Bank and Union Investment, without the need for central clearing and paper-based global certificates.

Siemens highlighted the benefits of using digital bonds over traditional bond-issuing methods in their announcement, stating that:

“…issuing the bond on a blockchain offers a number of benefits compared to previous processes. For instance, it makes paper-based global certificates and central clearing unnecessary. What’s more, the bond can be sold directly to investors without needing a bank to function as an intermediary.”

Ethereum Shanghai:

As the highly anticipated Ethereum Shanghai upgrade approaches in April, the network’s Sepolia testnet has been successfully upgraded, simulating the scheduled hard fork. The “Shapella” upgrade, which combines the names of the upcoming Shanghai and Capella hard forks, was successfully implemented on the testnet on the 28th of February.

Shanghai is the fork’s name on the execution layer client side, Capella is the upgrade name on the consensus layer client side. One of the major changes will be enabling validators to withdraw their staked Ether from the Beacon Chain and back to the execution layer.

The next step before the Shanghai fork goes live on the mainnet will be to release the upgrade on the Ethereum Goerli testnet. Ethereum developers are targeting 14th March for the release.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.