Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Written by Franz Steinbeiss

As the saying goes, the only constant in life is change. This is certainly true when it comes to financial markets, where volatility is a constant presence that can make or break investments.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a certain period.

In simpler terms, it’s a measure of how much an asset’s price tends to move up or down in a given period. High volatility means that an asset’s price can change rapidly and unpredictably. Low volatility means that the price tends to be relatively stable and more predictable.

Volatility is often measured using statistical tools such as standard deviation or variance. Standard deviation refers to how dispersed the data is in relation to the mean (the average), the higher the deviation the more spread out the data is. Variance measures the degree of spread in your data set, the higher the spread the larger the variation is in relation to the mean. Volatility is an important concept in finance and investing as it can significantly impact the risk-return of a portfolio of assets.

Investors and traders typically use volatility as a risk gauge when making investment decisions. Higher volatility is often associated with higher risk, but it can present opportunities for higher returns if the investor is able to successfully predict the direction of the asset’s price movements.

Volatility of stocks and cryptocurrencies

Stocks and cryptocurrencies alike can experience significant levels of volatility, but there are key differences between the two.

Stocks are ownership shares in publicly traded companies, and their prices are influenced by a variety of factors such as company performance, industry trends, and overall market conditions. Stock prices can be volatile due to changes in these factors, as well as shifts in investors’ sentiment and external events such as political developments.

Cryptocurrencies, on the other hand, are digital assets that operate independently of central banks and are secured by blockchain technology. Cryptocurrency prices can be volatile due to a variety of factors, including changes in supply and demand, governmental regulations & technological development.

Overall, while there are similarities in the volatility of stocks and cryptocurrencies, the underlying factors that drive price movements are different and the speed and extent of price changes can vary significantly between the two asset classes.

Volatility of cryptocurrencies and stocks over time

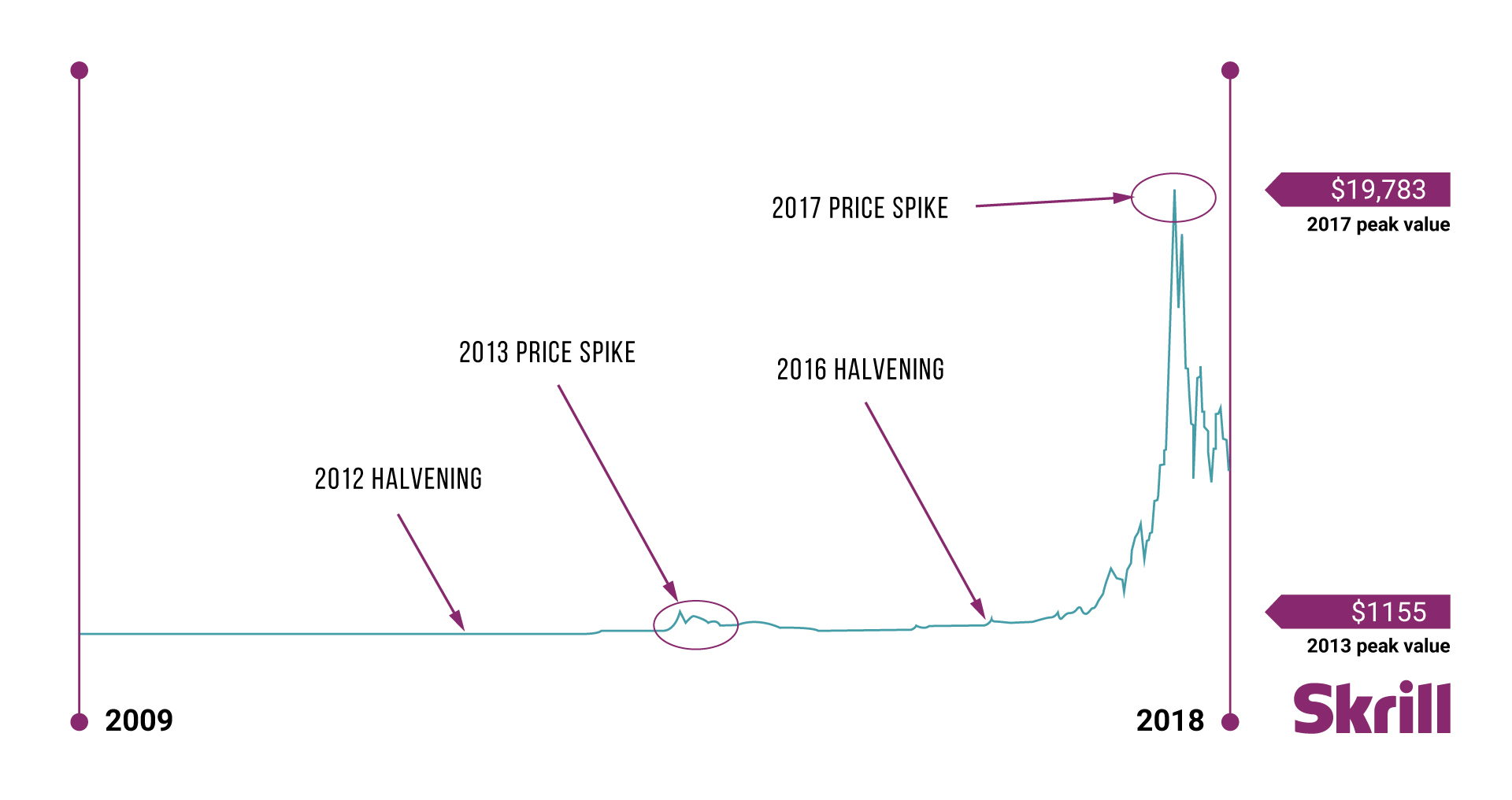

Historically, cryptocurrencies, mainly bitcoin, have been more volatile than major stock exchanges such as the S&P 500 or the Dow Jones Industrial Average. This is because cryptocurrencies represent a relatively new asset class, which has existed for just over a decade. Whereas stock indices have been around for much longer and have a more established track record. In 2021, bitcoin’s value ranged between €28,383 and €65,000 leading to an annualized volatility rate of 81% and a daily volatility rate of 4%. The major stock markets, such as the Dow Jones, which tracks the performance of the 30 largest publicly traded companies in the US, had an annualized volatility rate of around 17%.

With the start of the bear market in 2022 major cryptocurrencies declined from their all-time highs and hovered at lower levels. This also led to a reduction in the overall volatility, so bitcoin’s 20-day rolling volatility has fallen below that of the major stock indexes for the first time since 2020.

This data suggests that the cryptocurrency market is getting more resilient and less reactive to volatile macro events such as high inflation and rate hikes, leading overall to mellowing crypto price swings.

In addition, there’s a few other factors that likely contributed to a stabilization of the volatility within the cryptocurrency market. Firstly, a lot of investors tend to treat Crypto as a long-term investment, rather than a short-term investment, which creates stability in the prices and in turn reduces volatility. Secondly, the overall cryptocurrency market is maturing, as cryptocurrency is now more openly recognized as a mainstream investment option, helping the overall market capability to rebound after the sell-off last year.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies

- Set conditional orders to automate your trades

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.