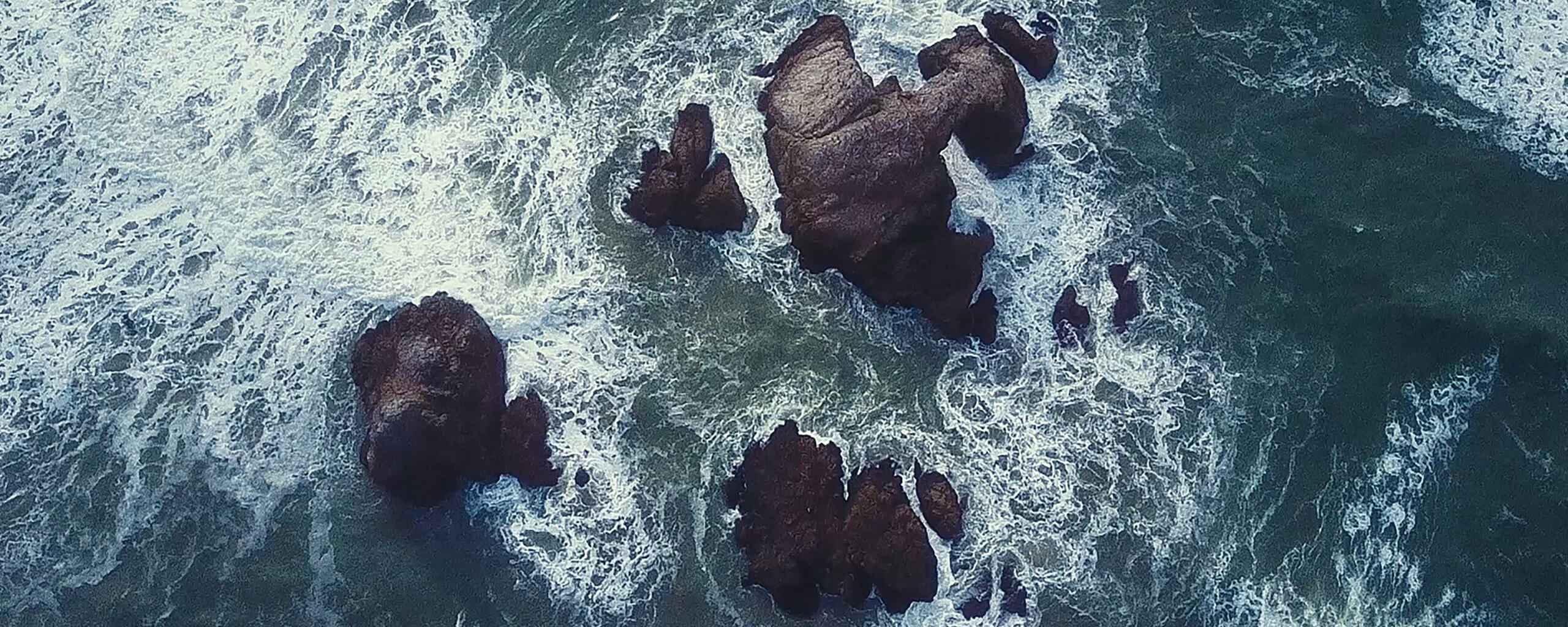

Looking to invest in emerging forex markets? Well you may want to hold on to your money as it’s been a pretty rocky year for most emerging currencies. But what’s been causing the unrest - and what are the risks?

Any country’s currency has three general factors to measure how risky it is:

- Its economic stability

- Its political stability

- Potential impacts from global events

Rates and volatility levels are continually changing so it’s important to do your research before making an investment decision.* We’ll be looking at the currencies of seven emerging markets: India, Mexico, Brazil, South Africa, Russia, Turkey and Venezuela.

The Indian rupee

The Indian rupee is at an all-time low. It’s been hit with a double whammy of higher oil prices, worsening the country’s debt, and an exodus of foreign investors.

However, India’s GDP actually grew by 8.2% for the first quarter of the fiscal year, suggesting the economy is generally stable.

- Volatility Rating: Medium

The Brazilian real

Leadership contests in Latin America are always a worry for market analysts. With political corruption fears commonplace and recovery from dictatorial pasts still ongoing, their results are unpredictable. With Brazil recently holding an election, the real hit its lowest level in over five years.

Despite this, Brazil is still a top pick in the emerging markets due to rhetoric from Jair Bolsonaro, the far-right, pro-business, and controversial contender for presidency. Known as the “Tropical Trump”, Bolsonaro’s comments around economic reforms are causing the real to rally.

- Volatility Rating: Low

South African rand

South Africa is encountering instability in its mining industry as a result of several new government policies. These policies aim to scale back the economy’s dependence on its mining industry, but have reduced the strength of the rand as a knock-on effect.

The rand is now a vulnerable currency - according to the Nomura “Damocles” index, it’s the second most likely currency to have an exchange rate crisis. A crisis would lead to a massive devaluation of the currency and likely intervention from the South African government.

- Volatility Rating: High

The Russian rouble

For the first time since 2016, the roublehas dropped down to 70 against the dollar. The currency has been hit by continued U.S. sanctions and - since Russia is a big oil exporter - the fall in oil prices earlier this year.

But thanks to a resurgence in oil prices, low inflation, and low amounts of hard currency debt, the rouble’s value has stabilised and is slowly growing again.

- Volatility Rating: Medium

The Turkish lira

Turkey has had its share of domestic political woes in recent times and now has to contend with a political fight with Washington.

According to published figures, the lira lost a whopping 44 per cent of its value against the dollar this year alone. These issues make it the world’s worst performing currency so far in 2018.

With so much market volatility around the lira, it’s worth knowing that you can instantly move funds across trading platforms in 40 different currencies with a Skrill account - ideal when you need to quickly move your money from one currency to another.

- Volatility Rating: High