The name “Andrew’s Pitchfork” comes from the name of Dr Alan Andrews, who developed a trading style that uses pitchfork-shape indicators to forecast future prices.

Although Andrew's Pitchfork is applied most often to the equities and futures markets, it can also help forex traders find opportunities in the intermediate and long term.

So what is Andrew’s Pitchfork and how do you use it? Here are some of the key facts.

The fundamentals

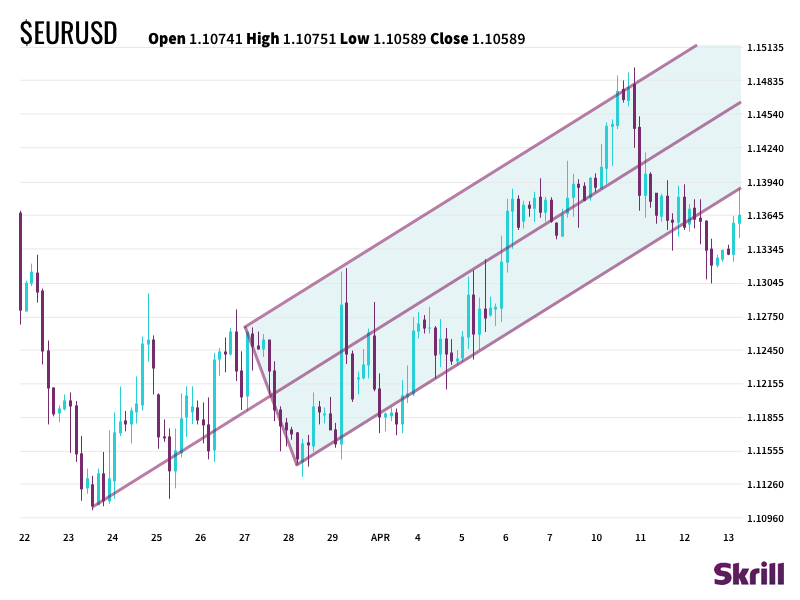

Andrew’s Pitchfork is a trend channel tool consisting of three lines centred on three points - a centre trend line with two further parallel trend lines equally spaced on either side of it.

As with normal trend lines and channels, the outside trend lines mark potential support and resistance areas. A trend remains in place as long as the Pitchfork channel holds. Reversals occur when prices break out of a Pitchfork channel.

Picking the three points

The first step to creating the pitchfork is selecting three points for drawing the trend lines. These points are based on highs or lows (also called pivot points) and are placed at the end of previous trends.

Ultimately, there are no set rules about how to place your points and draw the channels. It’s a matter of judgment that can only come from experience.

Hence, the pitchfork is most suited for intermediate and advanced traders.

The pitchfork shape itself is created by drawing a line from the first point that runs through the midpoint of the other two points. All pitchforks have three lines, and each line starts from one of the pivot points. The lines are called the upper line (UL), the lower line (LL) and the median line (ML).

The pitchfork is intended as a quick and easy way for traders to identify possible levels of support and resistance for an asset price or currency.

However, the most important thing to remember when trading with a pitchfork is that different pivot points will result in different angles for the overall pitchfork, which will then lead to different results when interpreting the market.

Trading with a pitchfork – the basics

When using a pitchfork, forex traders will buy a currency when the price falls near the support of either the centre trendline or the lowest trendline.

On the other hand, they'll sell the currency when it approaches the resistance of either the centre line or the highest trendline.

While the centre line can be used to identify areas where a currency may find support or resistance, this is not as strong a guide as the two outside lines.

Prices should reach the median line on a regular basis during an uptrend. Failure to reach this line shows underlying weakness that could mean a trend reversal will soon happen.

Stop loss placement

Consider an example whereby a currency has found support near the bottom trendline twice over the past quarter. This would make placing a stop loss just below this level a logical choice.

Should the currency then break above the resistance of the centre line, the forex trader’s target would then change to the top line, with the centreline becoming the new support.

Steepness

The steepness of the channel depends on where the three drawing points are placed, particularly point one, which is the start of the median line.

Even though point one usually starts with a reaction high or low, it’s sometimes necessary to adjust point one to ensure a realistic price channel that is in line with actual market behaviour.

Mastering pitchfork indicators

As mentioned above, there are no hard rules for point placement. Instead, traders must use judgment and experience when drawing channels.

As with most aspects of technical analysis, it’s important to build your forex skill and understanding by experimenting. Seeing what does or doesn't work first-hand is the only way to truly master an indicator.