The Skrill Prepaid Mastercard® isn't available in the USA. Click here to visit our US website.

The Skrill Prepaid Mastercard®

Pay online, spend abroad and withdraw cash. The Skrill card is your balance on the move.

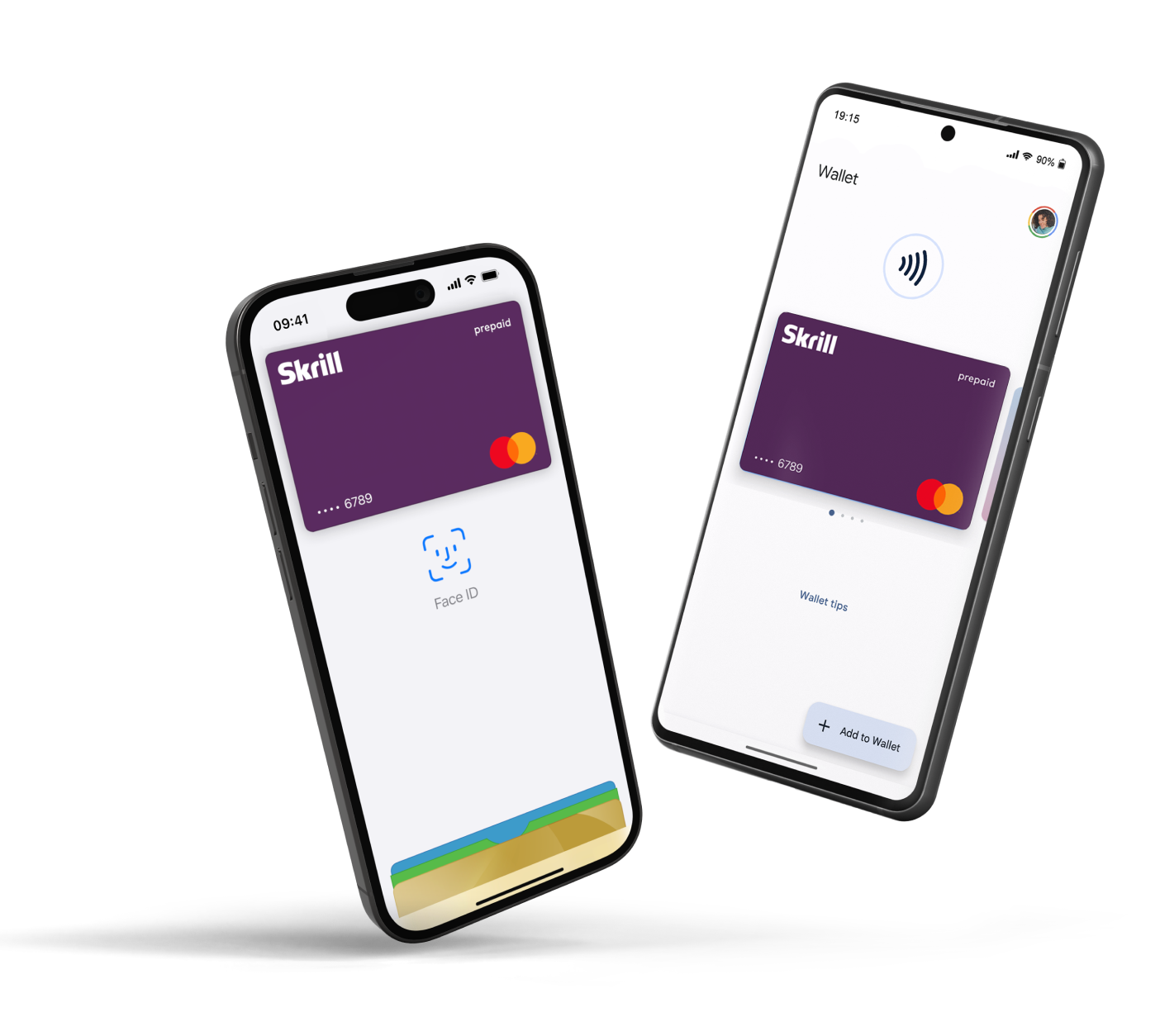

Use Skrill with Apple Pay® and Google Pay™

The easy, secure, and private way to pay with the devices you use every day. Simply add a Skrill Mastercard to your Apple Wallet® or Google Wallet™ to make speedy, contactless payments.

Get it on Google PlayDownload on the App Store

Your Skrill Prepaid Mastercard®

Order your physical prepaid Mastercard today and we will issue your digital card on the spot. Simply add it to Apple Pay® or Google Pay™ and start using it while you wait for your physical card to arrive.

Instantly access your account balance and use your Skrill card abroad anywhere Mastercard is accepted. Use contactless payment in-store and withdraw cash from ATMs worldwide.

There are no credit checks, and you benefit from the added security of your Skrill balance being separate from your bank account.

Knect: Get more from your prepaid Mastercard®

Make your prepaid card work even harder for you with our Skrill loyalty programme.

Every time you use your Skrill Prepaid Mastercard®, you earn Knect loyalty points. Exchange your points for cash vouchers, bonuses and more.

Download the Skrill app

Download the Skrill app today and take control of your money. View your card transactions, top up your card and check your PIN, all with one app.

Plus, if you ever misplace your prepaid card, or simply want more control over your spending, you can now lock and unlock your card in the app.

Where do I get my prepaid Mastercard®?

-

Apply

Log in to your Skrill account, go to the Skrill Prepaid Card tab and order it instantly.* Don’t have an account? Sign up here.

-

Use

Start using the digital copy of your card today by adding it to Apple Pay® or Google Pay™.

-

Activate

Once you receive it, activate it in-store or at ATMs by inserting it into the card machine and entering your card PIN.

FAQs

Can I order my Skrill card now?

If you are an existing Skrill customer residing in a supported country, you can order a Skrill Card* right now.

Simply log into your account, go to the Skrill Card section in My Account and click on Apply now. Please ensure you make any necessary amendments to the shipping address and the currency in which your card will be denominated.

Please also note that your account will be charged with the card's annual fee of €10.

Once you order your Skrill card* you may expect it delivered to your address within 15 business days. While waiting for your physical card to arrive, use the digital copy of your card instantly for online purchases or simply add it to Apple Pay® or Google Pay™ for in-store payments.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

How can I find the digital copy of my card?

If you would like to start using the digital copy of your card while the physical one is in transit, follow these steps:

- Log in to your Skrill Account

- Visit the Skrill card section to view your digital card number

- Add it to Apple Pay® or Google Pay™ for in-store or online payments

How can I use my Skrill card instantly?

From 7 December 2022, new card applications will no longer need to activate the card via the app to use it. Only new card applications can instantly be used for online, in-store, and ATM transactions. Any replacements (lost or stolen, renewed, and damaged cards) would continue to need to be activated via the app.

My Skrill Prepaid Mastercard® payment was rejected. What is the reason?

We recognize that it’s frustrating when a card payment is rejected. Your Skrill Prepaid Mastercard* payment may have been rejected for a variety of reasons: you have reached your limit, your balance isn’t enough to cover the payment, there’s a temporary restriction on your card or account, or you were attempting to use your card to purchase restricted goods or services.

Please check our Terms of Use for allowed payment types, and make sure your card or account are not temporarily disabled.

If you believe you had a sufficient balance and that the payment should have been processed successfully, please contact the Skrill Help Team.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

How much does it cost to get a Skrill card?

The services below that are available with your Skrill Card* are free of charge:

- FREE to pay for goods in shops, restaurants and online.

- FREE balance enquiries.

- FREE online statements.

- FREE PIN reissue.

All cardholders are required to pay an annual fee of €10 , a 1.75% ATM fee and 3.99% foreign exchange also applies.

Fees may differ or may not apply, depending on a customer's VIP status. You can see a full list of our charges under Fees in the Skrill Card section of the Skrill website.

I've forgotten the PIN for my Skrill card. What do I need to do?

If you're forgotten the PIN for your Skrill Card*, you can order a PIN reminder free of charge by following these steps:

- Log in to your Skrill Account.

- Go to Skrill card.

- Click on Retrieve PIN.

Please protect your PIN, never write it down and never disclose it to anyone.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

How do I activate my Skrill card for contactless payments?

For security purposes, you need to activate your card for contactless payments. Make your first transaction in-store, or at an ATM by using your card with the PIN to activate it for contactless payments.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

My Skrill card is lost or stolen. What do I need to do?

To report a lost or stolen card*, log into your Skrill account and go to the Skrill Card section.

Alternatively, you could call our dedicated "Lost & Stolen card" line (available 24/7) on +44 (0) 203 308 2530.

Your card will be cancelled immediately, and you will be able to apply for a new one.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

I ordered a Skrill card but it never arrived. What should I do?

Once you order your Skrill Card* you may expect it delivered to your address within 15 business days. If you have not received your card after this time, please contact the Skrill Help Team, providing your postal address in the following format:

Country:

City:

ZIP/Post code:

State:

Address:

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

How do I top up and manage my Skrill card?

To top up your Skrill Card*, you need to upload funds into your Skrill Digital Wallet, as the two are directly connected.

Simply log in to your Skrill account, click Deposit and choose the option that's most convenient for you.

Any transactions you make with your card will appear in the Transactions section, which you can check online at any time.

To manage your Skrill Card, simply click on the Skrill Card section of your account.

*Skrill card is only available to residents of authorized European Economic Area (EEA) countries and the UK.

Skrill’s offering of and support to the Skrill Prepaid Program is limited to residents of the European Economic Area and the UK.

Card Fees

Our fees are transparent, so you always know where you stand. Here are the fees we charge for using our Skrill Prepaid Mastercard®.

-

Free of charge*

Paying in shops, restaurants or online

Online statement

Pin re-issue*Fees may apply where currency conversion is involved.

-

Fees

3.99 % FX fee

1.75 % ATM fee**

10 EUR annual fee***

10 EUR new card application fee****Subject to successful identity and residency verification

**Local ATM surcharges may apply

***These fees are converted if the customer wallet currency differs