Welcome to your crash course in basic forex trading. Now’s a great time to spend learning more about how to trade currencies safely and skilfully online.

Here we explain what forex trading is, and how you can improve your skills as a newcomer.

What is Forex trading?

The word ‘forex’ is simply the shortened version of ‘foreign exchange’.

Forex trading refers to the process of trading one currency for another – most often, with the aim to make a profit from a trade.

Foreign exchange takes place on the foreign exchange market (also called the FX market). This is a global marketplace for exchanging national currencies against one another.

As a result of the worldwide reach of trade, commerce, and finance, forex markets are some of the largest and most liquid asset markets in the world.

Every trade revolves around the rates for different exchange rate pairs. For example, USD/GBP.

Forex markets exist both as ‘spot’ (cash) markets as well as derivatives markets, which offer special ways to trade. Derivates are called ‘financial instruments’ and include forwards, futures, options, and currency swaps.

In general, forex traders use the markets to hedge against international currency and interest rate risk, to speculate on events, and to diversify portfolios.

Where should you trade?

Forex trading is all done online.

In fact, in the international forex market, there is no central marketplace for foreign exchange. Instead, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange.

To trade, you will need a forex broker.

Forex brokers give traders access to a platform where they can buy and sell foreign currencies. Forex brokers are also called ‘retail forex brokers’, or ‘currency trading brokers’.

There are many brokers for individual traders to choose from and they will provide you with trading software. Have a Google for recommended brokers and keep an eye out for those that don’t have extensive transaction fees — as each trade will incur a fee.

How do you trade?

Once set up with a broker, they’ll have trading software you can start to explore. This software will have everything that you need to start placing bids and making your trades.

Make sure you understand how your trading platform works before you begin and that you have a solid trading strategy behind you.

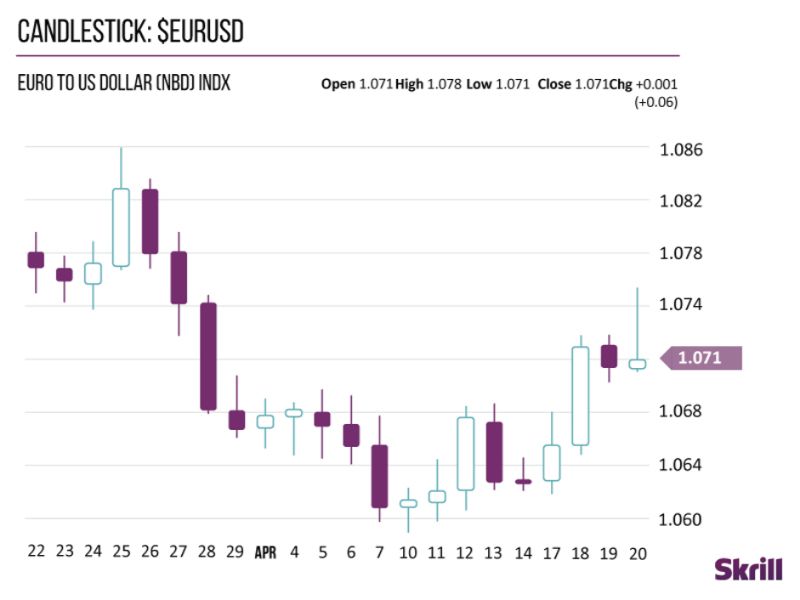

You should also make sure that you’re familiar with reading trading charts. There are line charts, bar charts and candlestick charts, and they all indicate how the market is performing in different ways.

At a basic level, the charts will show you the opening and closing values of a given exchange rate pair.

Read more about how to use charts to guide your forex strategy.

Consider the candlestick chart below. If the middle block is filled or coloured, the currency pair closed at a lower price than it opened. Whereas an unfilled or different coloured middle block shows that the closing price was higher than the opening price.

From here, you can start to see trends and anticipate ‘indicators’. Learn all about this and other ways of reading the candlestick charts.

How to pay

Finally, you’ll need to set up an online wallet to deposit and withdraw trading funds securely. The Skrill wallet is perfect for that. It’s fast and secure.

Why not take some extra time to learn about trading strategies and how to interpret those candlestick charts to improve your trades.