The Skrill Prepaid Mastercard® isn't available in the USA. Click here to visit our US website.

Budgeting is the process of creating a plan for allocating income to specific financial goals and expenses. To do this, you need to review your income and expenses, identify costs that you can reduce, and define a saving plan that allows you to achieve your dream car or the vacation you’ve always wanted.

Budgeting is an essential tool for managing your finances and achieving your goals – and gives you a clearer picture of your financial situation. With the information, you can make informed decisions about your expenses and savings.

There are various tools that will help you maintain control over your budget and finances: the traditional method of recording expenses in a notebook; the creation of an Excel spreadsheet for automated planning; or you can download a personal finance management application to your mobile phone or computer.

Alternatively, you can opt for a reliable and intuitive tool for controlling costs: a prepaid card. With the Skrill Prepaid Mastercard® you can’t go overdrawn; once you’ve spent the funds on your card, there’s no way to continue spending without loading more money onto it.

What is a prepaid card?

A prepaid card is like a regular debit card, but you must top it up with funds before you start using it.

The main difference from a bank card is that you can’t spend more than the balance you added to it. Other than that, you can use it to make purchases (in stores or online) and withdraw cash as normal.

A prepaid card is a convenient option for those who don’t want – or are struggling to get – a traditional credit or debit card.

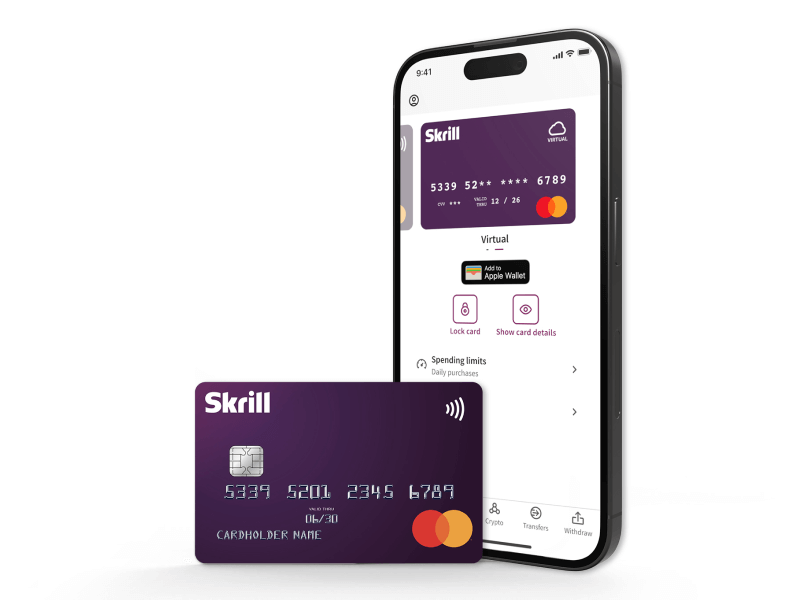

Getting your Skrill Mastercard is easy and fast. The simple process takes only four steps to complete. Learn more here.

You’ll also receive a virtual version of your prepaid card, which you can add to Apple Pay®, Google Pay™ and Samsung Pay.

How to budget with your prepaid card

Here are some tips for budgeting with the Skrill Mastercard:

Establish a budget: Before you start using your prepaid card, establish a personal budget. To do this, determine how much you can spend each week or each month, and load your card with that amount. This way, you avoid the need to keep topping up and stay true to your budget.

Monitor your balance: Regularly monitor your prepaid card balance to check how much you have left to spend. The easiest way to view your balance is in the Skrill mobile app. Regularly checking how much money you have left will avoid the unwanted surprise of a transaction being declined due to insufficient funds.

Budget for future purchases: If you want to save for a house or a car, the Skrill prepaid card makes it easier to stick to your budget; only add the amount you’ve set aside for your expenses to ensure you don’t exceed your target spend. With no overdraft or credit limit to tempt you into spending more, it’s a great way to keep control of your expenses.

Remember these three things to keep in mind when using your Skrill Mastercard for personal budgeting:

- Establish a budget

- Keep track of your balance

- Plan for future purchases

Get your Skrill Mastercard today and try a new way of controlling your finances.